Taking control of third-party spend is an effective way to generate more cash for your business.

Why would more cash be good in an uncertain economic environment?

It’s simple: more flexibility and control.

Even if cash isn’t “king” like some say, cash can be used as a buffer against potential financial losses, to pay down debt, or to purchase discounted assets. To those aims, implementing spend controls generates direct and indirect benefits to the business during times of heightened volatility and risk.

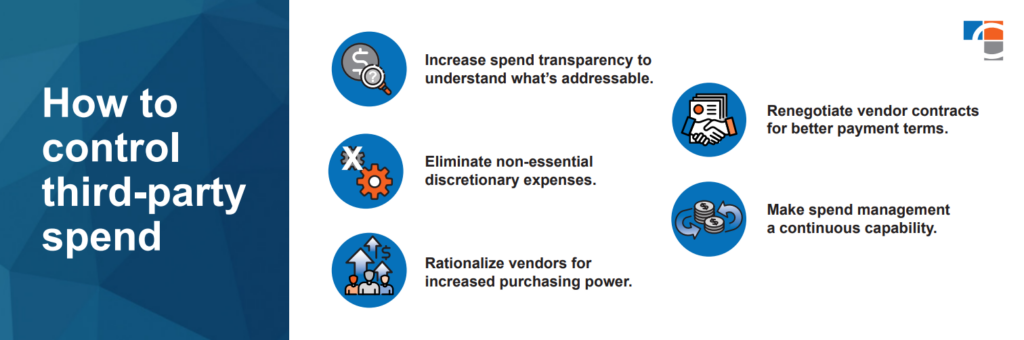

Here’s how you take control of third-party spend.

1. Increase Transparency of Current and Future Planned Spend to Understand What’s Addressable

It’s hard to improve spend if you don’t know what you’re spending money on today.

Spend analytics tools like Coupa are an easy and effective way to simplify the categorization and analysis of third-party spend data.

Combine an analytics capability with a procurement team that has more visibility and governance over spend, and you then can:

- Determine what is addressable for improvement.

- Set improvement targets by category.

- Track savings.

2. Eliminate Non-Essential Discretionary Expenses to Find Immediate Savings

Spend transparency — just like if it was your own personal monthly bank statement — opens your eyes to expenses you simply don’t need.

If you need to move fast, you can take a top-down approach to look at expenses by category and use a red pen to cross off items you no longer need.

A more effective strategy is zero-basing spend. This will challenge you to think hard about what you really need, not what you have today, and normally leads you to a materially lower spend answer than the top-down approach.

3. Rationalize Vendors to Increase Purchasing Power

If you have visibility into spend and have already cut out any unnecessary expenses, keep going. Take a hard look at your list of vendors and remaining spend, and you should find opportunities for additional consolidation.

“The most profitable organizations embed spend management processes and capabilities into their organization so that it becomes part of their DNA.”

Blake Baptist, Strategic Cost Improvement Director

It might be the case that you have two business units purchasing similar widgets from different suppliers. Or, some of your vendors can supply additional products and services you’re currently buying elsewhere.

Regardless, the more you buy from vendors, the more purchasing power you build.

But it’s important you have proper vendor management processes in place to avoid too much supplier risk.

4. Renegotiate Contracts With Vendors to Enable Better Payment Terms

Once you’ve streamlined into a manageable set of vendors, those same vendors are likelier to seek to retain your business long term, including working with you in tough times.

Ever notice your household internet or phone bill suddenly increase, then you call the vendor to get the lower rate back? This concept can apply to your business too.

Reach out to each vendor, particularly for needle-moving expenses, and simply ask for opportunities to renegotiate rates or payment terms.

5. Make Spend Management a Continuous Capability so You’re Always Saving Money

You might start taking control of third-party spend during a challenging economic time, but you shouldn’t stop there.

The most profitable organizations embed spend management processes and capabilities into their organization so that it becomes part of their DNA.

Use a portion of your newly generated cash savings to invest in the following if you haven’t already:

- Developing sound end-to-end Procure-to-Pay and Order-to-Cash processes.

- Dedicating a strategic sourcing team to anticipate needs, vet and manage suppliers, and negotiate the best rates.

- Increasing procurement’s governance over spend so that more spend is under management of the supply chain function.

- Setting annual savings targets by function and/or category.

Need help actioning these five steps? Contact CrossCountry Consulting and start generating cash today.