How can CFOs push their teams to complete more transformation initiatives while still running a business?

The answer is velocity.

Here are five ways to get started:

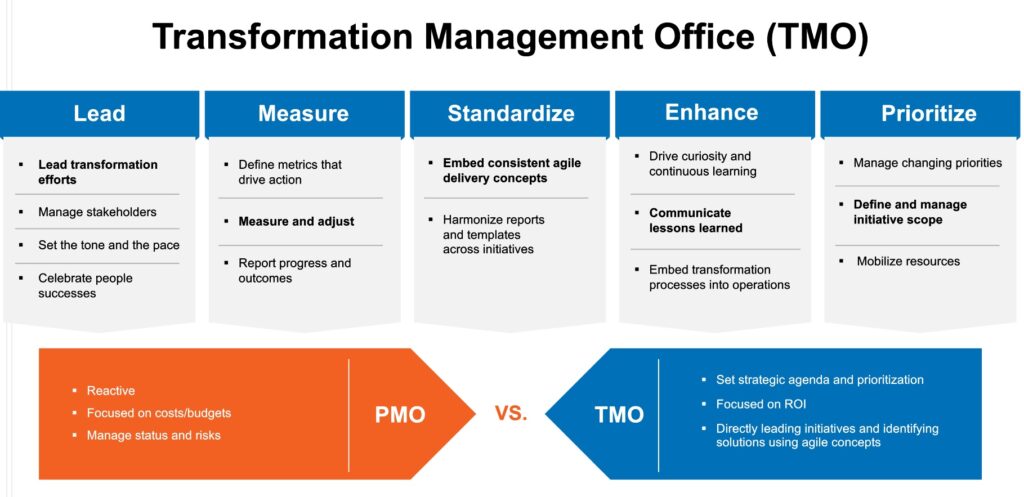

1. Drive Transformation and Continuous Improvement Through a Central TMO, Not a PMO

Labels matter.

There’s a negative connotation to the Project Management Office (PMO) label, although organizations have historically established PMO teams to manage roadmaps to completion.

Four things have always been true about traditional PMOs:

- They’re good at reporting status.

- They keep things organized.

- They don’t speed up progress.

- They’re often viewed as a nuisance rather than an enabler.

Alternatively, imagine a Transformation Management Office (TMO) that:

- Gets its hands dirty in process reviews with sprint teams.

- Challenges the status quo.

- Celebrates the success of others by sending weekly success spotlights rather than weekly status updates.

Look at the differences between the PMO and TMO to see how your organization can benefit from making the shift:

2. Use Agile ‘Lite’ Instead of Forcing Too Many Complex New Concepts

Agile is now commonplace for all project delivery types, not just technology implementations. The challenge is that it’s like learning a new language.

Rather than creating a science project for your teams, infuse simple but effective agile concepts into a transformation by leading by example.

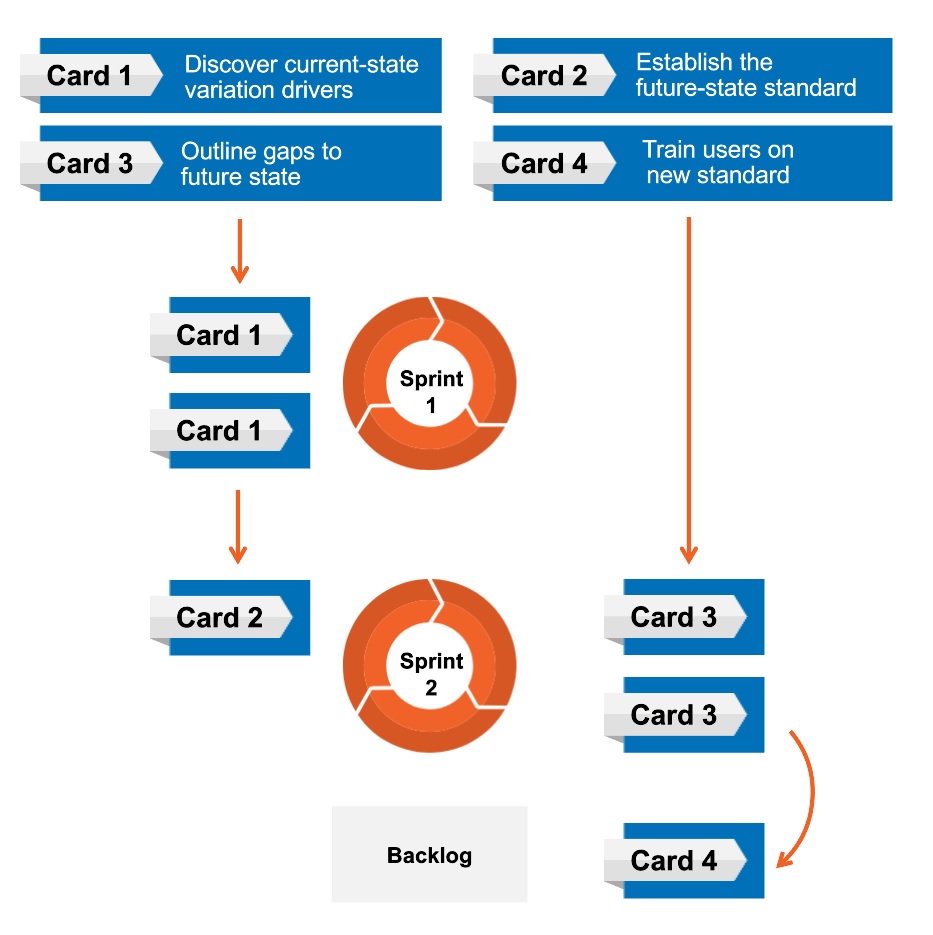

Start with easy-to-apply agile delivery concepts, such as:

- Sprints: Each initiative should be broken into 4-week sprints. Multiple sprints run in parallel. There’s one week reserved after each sprint to report outcomes and plan for the next round of sprints. Pencils must go down regardless of progress at the end of each sprint.

- Cards: Deliverables for an initiative can be conveniently visualized through cards. Sprint teams select cards before the sprint and only focus on one thing at a time before moving to the next card. This enables teams to declare victory faster and more frequently. More victories correlate to transformation success.

- Scrums: A daily 15-minute meeting with the support of a Kanban Board focuses teams on the activities for that day and removes blockers from completing those daily tasks. Don’t let anyone work on meaningless tasks. Toyota invented the Kanban Board to best control and manage work at every stage of production. Their effective use is storied and diverse. Kanban Boards can also be fun and interactive, contributing to positive morale and collaboration.

The illustration below represents an agile workflow for standardizing accounts payable processes:

3. Embrace “Ish” as Opposed to Perfection

“Ish” is a hard concept for finance and accounting professionals. It can apply to assessing processes to make them more risk-based, and it can also apply to a “good enough” definition of done.

Transformation should be more about elevating organizational capabilities and finished products rather than perfection.

For example, one sprint may be focused on process discovery for the Procure-to-Pay process. You may not achieve best-in-class cycle times by the end of the sprint, but if you end the sprint with a better process, move on and solve the next problem.

Luckily, the word “ish” is in the word “finish.” Use this concept and you will finISH more initiatives.

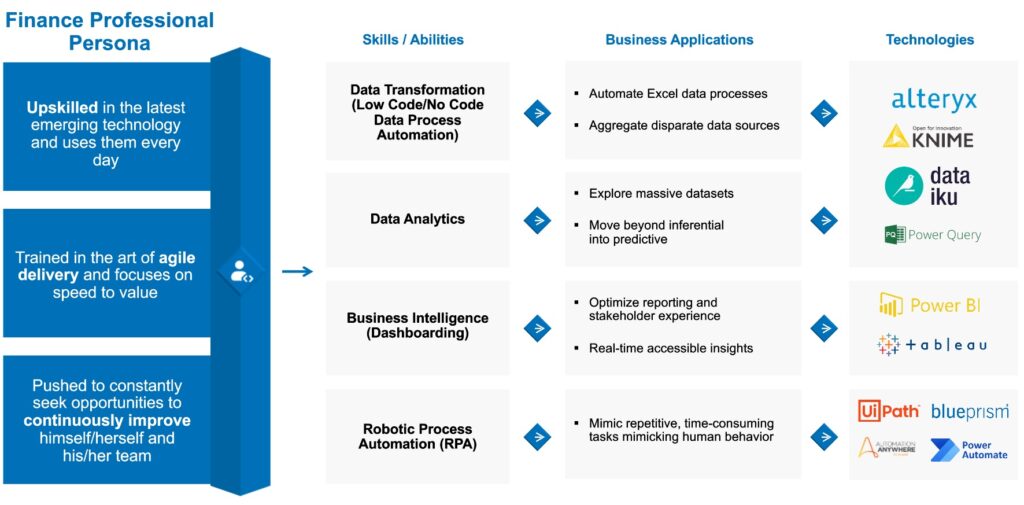

4. Put a Few Experts in Emerging Digital Tools on the Ground

Companies invest in emerging tools like UiPath, Alteryx, and Tableau to generate process efficiencies, but the problem is that the average employee doesn’t know how to use these tools effectively.

The organizations that will succeed in transformation velocity understand the importance of putting the right tools in the hands of sprint teams and teaching those teams how to use those tools.

One quick way to catalyze the use of new tools is to implant a few experts as “champions” in the finance function. Have them build proofs of concept while they simultaneously upskill others on how to use the same tools.

For example, the close process has heavy automation potential. Instead of planning an optimization project that takes a lot of time and money, an analyst on the accounting team should know how to create a bot within UiPath to automate a specific task.

The finance professional of the future will be upskilled in the latest digital tools and will use these tools to continuously enhance ways of working so that they can focus on higher-value tasks. The image below highlights the skill sets and technology capabilities that separate traditional finance professionals from those who are future-ready:

5. Execute in Tiny, Dedicated Teams

One of the most common transformation mistakes is expecting employees to keep doing their day jobs in addition to transformation work.

Speed and part-time resources don’t go together in the same sentence. Sprints only work if people are dedicated, and it doesn’t need to be a lot of people.

A quote we like to use internally rings true: “It’s better to have 2 people at 100% allocation than 10 people at 40%.”

To execute successfully on your next transformation, contact CrossCountry Consulting today.