Permacrisis: The Collins English dictionary’s 2022 word of the year meaning “an extended period of instability and insecurity.”

What will 2023 bring? A recession? More instability?

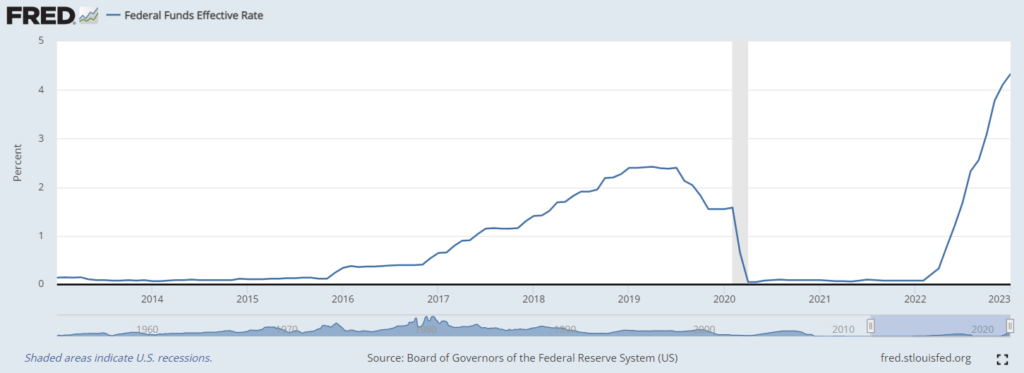

According to the Fed, rate hikes to battle inflation could ease in 2023, but most leading economists still believe a recession is looming, even if they don’t agree on the exact timing, magnitude, or duration. Because recessions trigger severe stock declines, high unemployment, lower consumer spending, and a reduction in investment activity, companies with ample cash to fund operations and continue growth investments will emerge stronger coming out of recession than undercapitalized competitors.

CFOs have their work cut out for them. In 2023, it’s time to go on offense before the market forces you to play defense.

Here are five counter-cyclical measures all CFOs should consider (in order of effort, starting with the least):

1. Change Payment Cycles to Generate Quick Cash

Turn receivables into cash by giving customers discounts for early payments, resolving large-dollar disputes, and generating invoices through automation. Secondly, stretch or reduce liabilities by asking vendors for early-payment discounts, extending payment deadlines, and rethinking non-essential payments.

Most companies, particularly smaller private ones, lack formalized cash-management processes. A comprehensive 13-week cash flow model with associated weekly reporting processes can help identify near-term opportunities to optimize working capital and more proactively manage cash.

Opportunity indicator: Useful for all firms of all industries and sizes.

2. Control Third-Party Spend

Strategically plan for and source all future third-party spend, gain visibility into current vendor spend, and identify opportunities to rationalize current spend by completing one or more of the following:

- Consolidating vendors.

- Negotiating better terms.

- Eliminating non-essential discretionary expenses like subscriptions, travel, meals, and entertainment.

Most companies have procurement capabilities or departments, but fewer have strategic sourcing. As seen time and again, companies with sourcing capabilities typically have lower costs. As a solution, a rapid spend diagnostic locates opportunities to optimize current vendors and spend, which helps establish sourcing capabilities that better control spend long term.

Opportunity indicator: Useful for firms with no sourcing team and/or that only have visibility into <70% of supply chain spend.

“Companies with ample cash to fund operations and continue growth investments will emerge stronger coming out of recession than undercapitalized competitors. To separate from the pack, CFO must go on offense.”

Blake Baptist, Strategic Cost Improvement Director

3. Materially Reshape and Resize the Org

Build a blank-sheet org and delivery model that is more strategically aligned to the business’s needs, has optimal spans and layers, leverages automation for repetitive activities, and uses low-cost centers for non-essential activities.

When the market sours, companies react by reducing workforces and trying to do the same work with fewer people. These companies tactically look for places to cut, leading to incremental savings (e.g., 10%), which cannot be sustained. Take a more strategic approach by:

- Setting a clear vision.

- Benchmarking functional costs versus peer group companies.

- Conducting activity surveys to find waste or opportunities for automation.

- Building a blank-sheet org and delivery model that is materially lower cost (e.g., 20-30%) and supports sustainable growth.

Opportunity indicator: Useful for firms with general and administrative costs divided by revenue (G&A/revenue) >10%.

4. Develop Dynamic Planning and Forecasting Processes Adaptable to Market Swings

Enterprise Performance Management (EPM) shifts planning from Finance alone to the entire company. This makes forecasts more realistic and prompts individual departments to become more accountable for hitting numbers. Supported by a comprehensive EPM tool like Onestream, EPM makes enterprise data and planning more visible and accessible, converting key planning and forecasting processes into continuous actions rather than a single event that occurs annually.

Planning processes must be integrated into the business to achieve an EPM-ready operating model.

Opportunity indicator: Useful for firms in which solely Finance performs planning and forecasting and/or CFOs are unsure where to begin on the aforementioned counter-cyclical measures.

5. Monetize Non-Core Businesses That Drain Cash

Carve out an underperforming or less-synergistic business from the rest of the portfolio to generate value or tax savings from a divestiture.

All deals, even smaller carve-outs, are difficult because they require expertise and capacity firms often lack, especially in tough economic times. Key specialties required include running a separation management office (SMO), establishing transition service agreements (TSA), assigning contracts, distributing comms, and everything in between.

Opportunity indicator: Useful for firms whose primary segment/product is <50% the market share of the market leader, has <10% annual growth, and/or spends more to grow relative to other business units.

For expert support navigating recessionary pressures, contact CrossCountry Consulting today.