A revolution is underway in the world of Environmental, Social, and Governance (ESG) issues.

It doesn’t have to do with electric cars, windmills, hydrogen power, or solar cells.

It’s behind the scenes but no less important: ESG reporting is now merging with conventional financial reporting practices, resulting in a paradigm shift for public companies’ processes, vulnerabilities, advantages, and perceptions.

The finely tuned mechanics of financial reporting – corporate reporting, disclosures, metrics, and KPIs – are applicable and soon enforceable within the ESG realm.

That means that within the next few years all public companies will compile standardized ESG metrics and have them reviewed, audited, and published for investors, shareholders, and the general public to review and analyze.

Is your firm ready?

ESG Reporting: Frameworks Emerge

The ESG universe is vast, including, among other things:

- Climate change.

- Pollution.

- Diversity, Equity, and Inclusion (DEI).

- Board diversity.

- Business ethics.

ESG in the corporate world refers to the process of developing a strategy to meet high-level sustainability goals and translating these into specific reportable metrics for investors, shareholders, and others.

Global umbrella organizations such as the United Nations (UN) and the World Economic Forum (WEF) have helped define ESG goals, which to date have been abstract, such as “No Poverty,” “Zero Hunger,” or “Gender Equality.”

Though worthwhile, these goals must be converted into objective, measurable metrics before they can become meaningful tools for the corporate world.

Enter frameworks and standards.

- Frameworks create a structure that helps companies align toward the high-level goals and includes things like governance structures, targets, and risk management strategies.

- Standards define industry-specific metrics to be disclosed, creating a common language for companies and investors.

Taking a Page from Financial Reporting

In the financial reporting world, the goal is “Transparent Financials.”

Groups like the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) establish financial reporting frameworks. Then, these frameworks are used to underpin and define standards, such as U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). It’s these types of standards that institute trackable metrics on which companies must report, ensuring that all relevant organizations adhere to consistent, transparent standards across the industry.

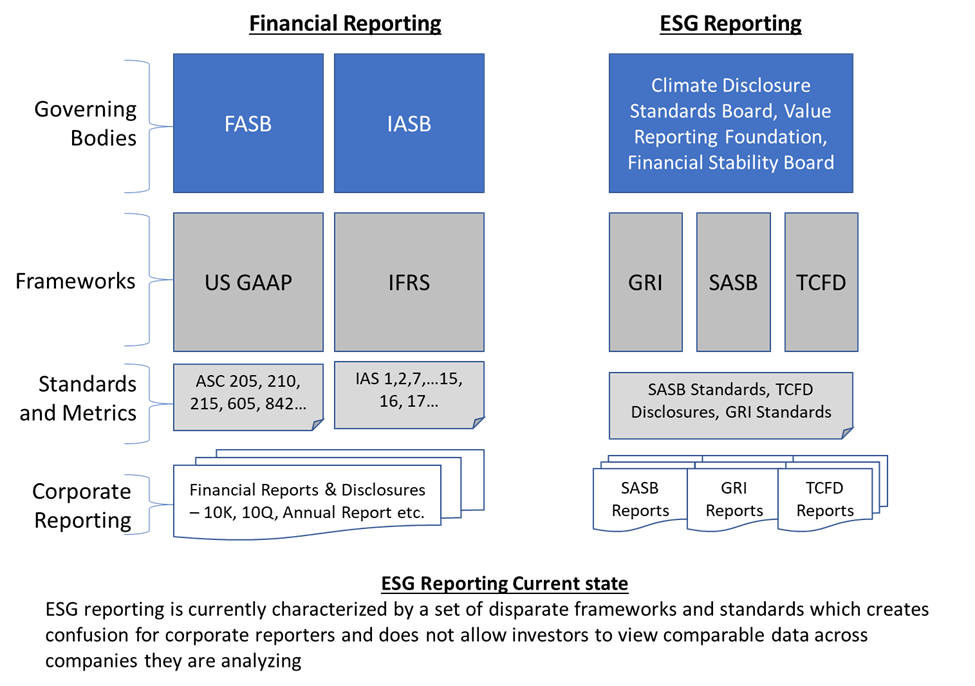

The exact same process is now playing out in the ESG world.

The Task Force on Climate-Related Financial Disclosures (TCFD), for instance, has established early concepts of ESG reporting that can meet UN and WEF goals. Similarly, the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI) are defining the actual metrics that companies must report.

These efforts ensure ESG reporting is transparent and consistent from one organization to another.

ESG Standards Mature

Between all of the aforementioned frameworks and standards, the current state of ESG reporting has created confusion for companies that want to report ESG metrics voluntarily.

Which standards should they adopt?

Should they report under more than one standard?

Below is a visual emphasizing the complexity and incongruity of reporting:

SASB: The Early Common Standard Frontrunner

An early front runner for a common standard was SASB, which created 77 distinct industry-specific standards focusing on the metrics most pertinent to that industry and has been adopted voluntarily in some aspect by over 50% of the S&P 1,200.

SASB received a huge lift in the last few years with the Big 3 U.S. investment managers – Blackrock, Vanguard, and State Street – publicly asking companies to publish disclosures in line with SASB and to disclose climate-related risks in line with the TCFD.

The critique of SASB was that it was not global in nature and lacked granularity on climate metrics, potentially requiring different reporting across jurisdictions. It needed a greater focus on climate.

ISSB: Charting a Future-State ESG Standard

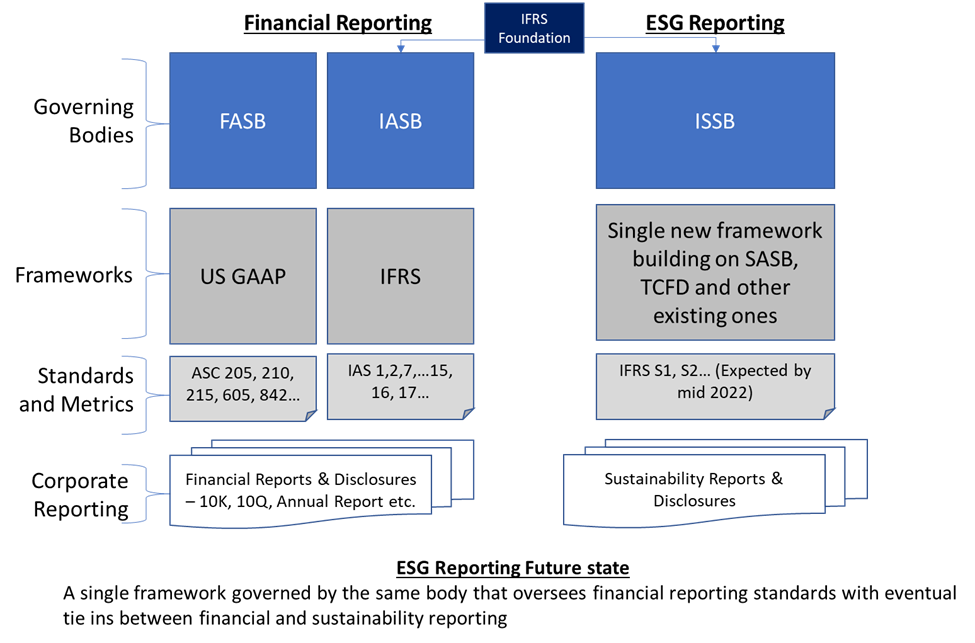

The latest iteration of a universal standard is the International Sustainability Standards Board (ISSB).

Established in 2021 at the United Nations Climate Change Conference in Glasgow (COP26) to develop a comprehensive global baseline of sustainability disclosures, ISSB has the same governance structure as the IASB, with both sitting under the IFRS.

ISSB standards will consolidate and build on existing frameworks, including SASB and TCFD, and are expected to be adopted worldwide through a combination of regulatory and market support.

It’s important to note that the contrast between GAAP and IFRS relative to financial reporting will not exist for ESG reporting. The ISSB intends to create a single global standard, with local regulators mandating ESG adoption for some businesses while investors demand voluntary ESG adoption for others.

Ahead of the ESG Curve

There’s no need to wait for ISSB standards to be worked on and finalized to begin work on ESG adoption and compliance.

These standards are being built upon well-defined, industry-specific SASB standards. Being SASB-ready enables companies to report and disclose metrics in the near term – when ISSB is fully up and running, significant rework won’t be required.

With the ESG reporting revolution upon us, a single, global standard comes into clearer focus. This will follow the tried-and-true model currently followed by financial reporting. Companies will report against the standard and the reports will be audited and utilized by investors, shareholders, and the general public for analysis from a sustainability perspective.

To remain ahead of the ESG curve, contact CrossCountry Consulting today.