Owners of private companies are increasingly eager to exit their investments as prolonged holding periods and fluctuating market conditions impact the market for sales and public offerings.

Interest and inflation rates, geopolitical developments, and election outcomes, among other factors, have introduced uncertainty into the timing, type, and value of exits.

However, indications suggest that the U.S. IPO market is gradually reopening, and the market for Special Purpose Acquisition Company (SPAC) transactions is also showing signs of resurgence.

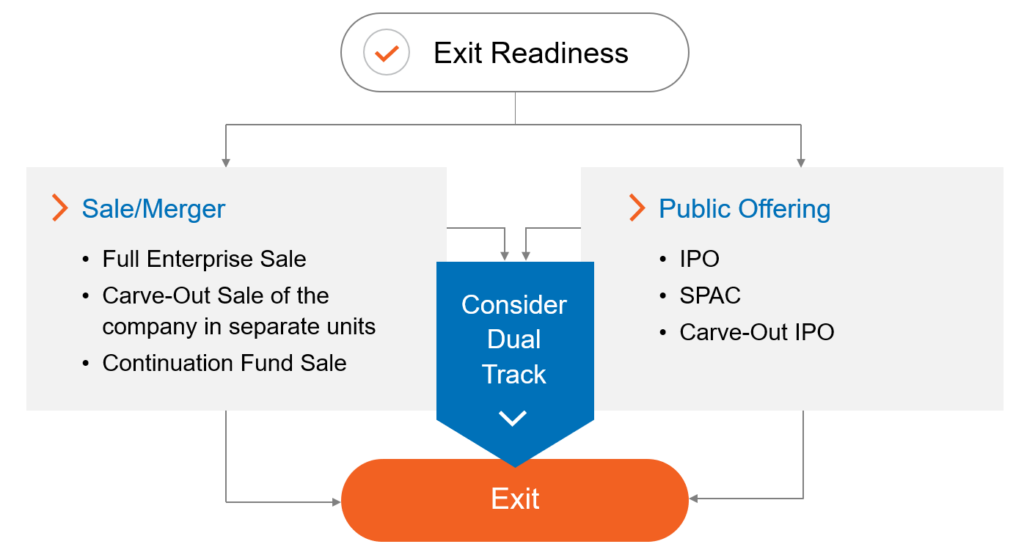

Determining the Appropriate Exit Strategy

In the current environment, multiple exit strategies are available for consideration. Owners must carefully evaluate their options and select the exit strategy that best aligns with their goals.

This evaluation often begins with an understanding of the dual-track exit, which encompasses both a Sale or Merger and Public Offering strategies. A dual-track approach allows organizations to remain flexible while maximizing their options. This approach helps ensure the company is always in a state of readiness, prepared with the agility to pivot based on market conditions, stakeholder priorities, and evolving business objectives.

Sale/Merger Track

- Full Enterprise Sale: Selling the company in its entirety to a corporation or another private equity firm.

- Carve-Out Sale: Based on a Sum-of-the-Parts valuation, it may be advantageous to sell specific units separately to maximize overall value.

- Continuation Sale: To circumvent holding period restrictions, a company may be “sold” from one fund to another within the same private equity firm.

Public Offering Track

- Initial Public Offering (IPO): Shares of a private company are offered to the public for the first time on a regulated market.

- SPAC: Merging with a SPAC can be a faster process with fewer requirements than a traditional IPO, though recent SPAC regulations should be considered with legal counsel.

- Carve-Out IPO: This involves the same preparatory steps as a carve-out sale with additional requirements for public registration.

Regardless of the exit type, companies transitioning to the next stage of their lifecycle require thorough exit preparation and potentially significant infrastructure investment. Fortunately, that transformation is consistent across exits, as the shift to a more efficient, de-risked operating model smooths the path toward a successful transaction. This preparation typically begins with an exit-readiness assessment, which is critical for determining the optimal exit strategy.

The Value of an Exit-Readiness Assessment

An exit-readiness assessment involves a comprehensive review of current business functions, historical performance, and future projections. Conducting this assessment well before initiating the exit process allows for the development of strategic roadmaps aimed at increasing value, addressing issues, and implementing necessary upgrades.

It’s a moment of self-reflection for corporate leaders: Do they have what they need and what it takes to execute a successful transaction?

The assessment documents the gaps in current-state operations relative to the future state and provides a roadmap for bridging those gaps, often in the form of upgrading or implementing technology, standing up a more effective process architecture, and aligning talent and investments to necessary areas of the business.

An exit-readiness assessment delivers numerous benefits applicable to all types of exits, such as:

- Developing an exit-ready timeline across functions.

- Identifying potential exposures and mitigating risks before a transaction.

- Developing a plan to address any identified exposures, including hiring strategy.

- Ensuring compliance with all applicable laws and regulations.

- Increasing chances of a successful transaction.

- Strategizing for deal synergies and realizing the investment thesis, including potential carve-out opportunities.

- Accounting for integration challenges and how to overcome them.

For public offerings, the assessment requires more time and regulation, necessitating an evaluation of timelines, stakeholders, costs, and the transformation required to meet higher reporting standards, including:

- Improving internal controls over financial reporting.

- Communicating effectively with investors.

- Evaluating quality and required effort of financial statements.

- Improving corporate governance practices.

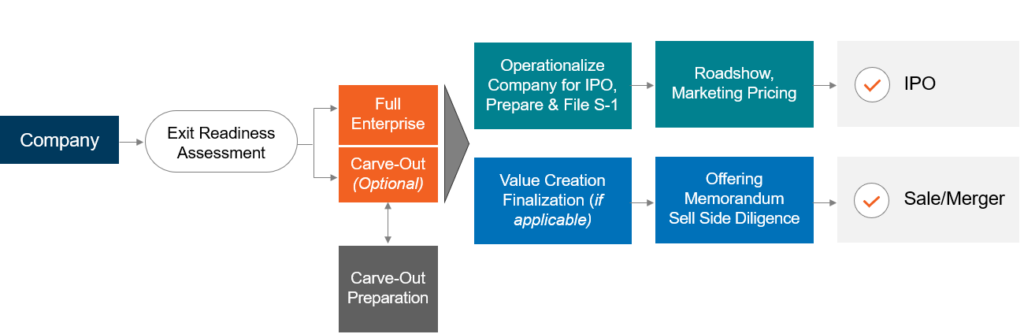

While these stringent requirements may not apply to a sale, process improvements can still facilitate a successful sale at a higher valuation. When exploring a dual-track exit approach, it’s advisable to differentiate between “requirements,” “needed solutions,” and “nice-to-haves.” After conducting a successful exit-readiness assessment, companies are prepared to move into the next stage of their exit, as shown in the diagram below:

Making the Exit-Readiness Transition

The transition from a private company to being exit-ready involves documenting operational gaps relative to the future state and creating a roadmap to bridge these gaps.

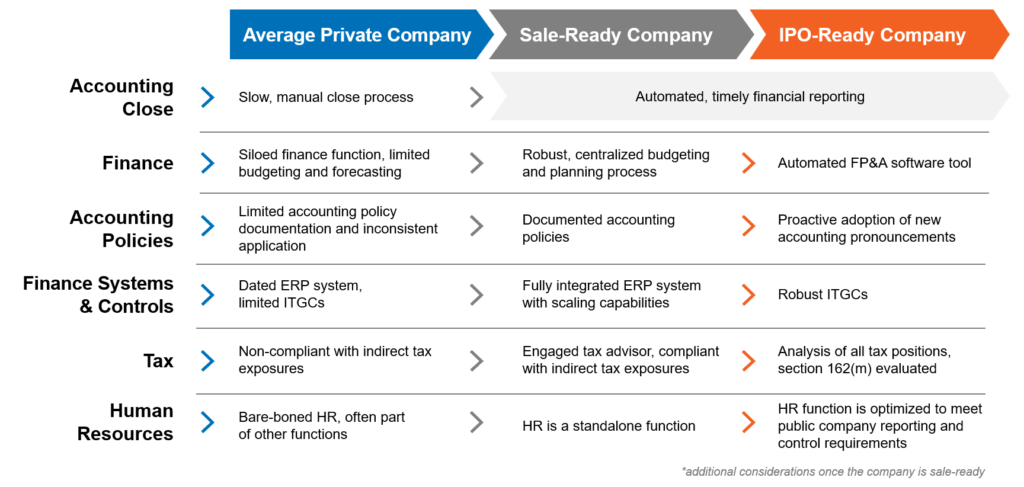

The graphic below illustrates common differences between a typical private company and one that is exit-ready. These activities represent core areas (Accounting Close, Finance, Accounting Policies, Finance Systems and Controls, Tax, and Human Resources) of the business that must be high-functioning and high-performing prior to an exit.

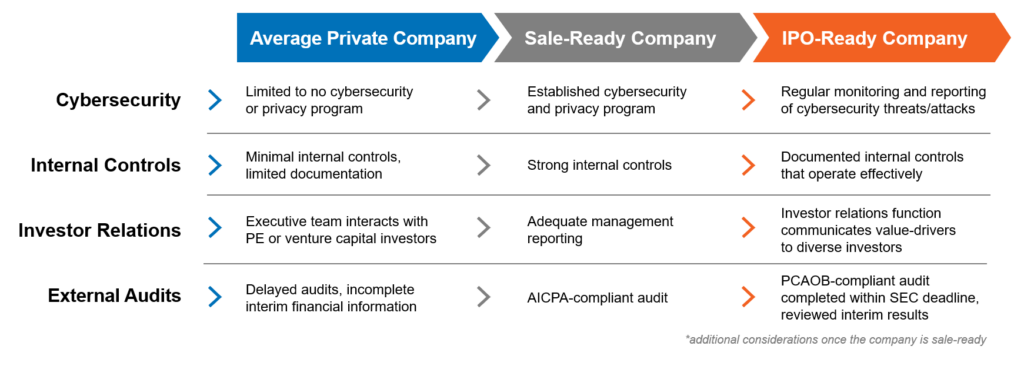

Focusing on these core areas is a good practice for aligning transformation priorities. However, as shown below, there are other areas of the business, including Cybersecurity, Internal Controls, Investor Relations, and External Audits, that should be established or optimized, especially when considering an IPO.

Planning for an Efficient Exit Process

Companies or funds planning an exit event in the near future should begin implementing operational enhancements well in advance to ensure consistency and success. To take the next step in the investment lifecycle and select the appropriate exit track, consider partnering with an advisor who can provide guidance across all stages and outcomes of exit-readiness planning.

Contact CrossCountry Consulting to strategically position your organization for a value-maximizing exit.