Each firm’s competitive advantage (and survival) depends on the daily decisions leaders make. In recent years, these decisions are more commonly being driven by a strategically positioned finance function.

This makes the effectiveness of the finance function a harbinger for the success (or failure) of the rest of the business. Modernizing the finance function for full efficiency, capacity, and ROI is thus imperative.

The modern finance function is powered by:

- Automation.

- Optimized operating models.

- Cost improvement.

- Analytics-rich insights.

- Value-add activities beyond transactions.

- Embedded digital skills and capabilities.

- Collaboration incentives and efficiencies.

Digital transformation initiatives in the finance function – such as robotic process automation – aren’t always easy to maintain, execute, and measure.

Even firms undergoing a transformation with the best of intentions and resources may be mismanaging forecasts, expectations, and implementation. For example, it’s estimated that just 30% of finance transformation efforts deliver the value that was initially projected.

In other words, real effectiveness is hit or miss.

What Is Finance Function Effectiveness?

Finance function effectiveness is the performance of the finance department in the pursuit of improving overall business results. An effective finance function provides deep, practical insights, growth recommendations, and faster decision-making for the organization at large – in addition to completing conventional financial back-office tasks.

At its core, the effectiveness of the finance function rests with its ability to be:

- Technology-adaptive.

- Growth-oriented.

- Risk-managed.

- Decision-ready.

- Cost-aware.

These capabilities permeate throughout the entire organization, not just within the Office of the CFO (OCFO).

The business may live or die based on finance capabilities and sophistication; it’s either a strategic differentiator or it can drag the business into irrelevance.

Traditional corporate finance metrics like operating cash flow, current ratio, and accounts payable turnover remain important, of course. But with greater adoption of software tools layered on top of new, agile operating models, the finance function consequently has new vectors, challenges, and opportunities to consider.

It’s not just financial reporting and governance. Leading finance functions must also be effective at managing tech stacks, upskilling employees for future demands, and servicing other departments with clean, actionable data.

CFOs can easily be stumped by ineffective teams and unsuccessful transformation efforts that aren’t yielding the value they anticipated, though. CFOs must develop the people and technology architecture to realize ROI in many different areas of the business, making their true mission the establishment of an organization that is ultimately and continuously flexible to change.

Adaptability to new revenue streams, integration opportunities, and market shifts separates successful OCFOs from those still focused on maintenance and administration.

Solving Historical Finance Challenges

In the basic sense, the finance core spends an inordinate amount of time processing transactions. In between brief moments of processing – if the internal resource is available – finance stakeholders can provide standard reporting to executives. In what little time is left, they may begin tackling larger, more strategic tasks.

This framework is rife with underlying difficulties, such as:

- Absence of a single source of truth (data spread across systems and people).

- Inadequate time spent on process improvement.

- Persistent cost pressure.

- Poor user experience handling rote tasks in legacy databases.

- Suboptimal speed to decision-making.

The model for running a traditional finance function does not allow for or incentivize analytical insights or transformation.

There is inherently always a tradeoff between completing the work immediately in front of you versus sinking time into high-value objectives. The payoff for choosing the latter may not always be evident or achievable, either, given the above constraints.

But the cost of not upending the incentives and time allocations is perhaps even larger in the end. The business may live or die based on finance capabilities and sophistication; it’s either a strategic differentiator or it can drag the business into irrelevance.

It must transition toward a future state that’s sustainable, forward-looking, and, above all, driving value that extends beyond the classic remit of the CFO.

Traditional finance, by definition, cannot be effective in today’s (or tomorrow’s) environment – even less so in hyper-competitive industries or in large enterprises with significant financial overhead.

The Future of Finance and Operations Effectiveness

While automation is one corner of a digital finance transformation, modern CFOs look more holistically at how the operating model can do more than ingest new tools and data.

They surface ways to build machine learning (ML) and artificial intelligence (AI) into automation programs for enhanced effectiveness. They level-up skill sets and solutions in line with organizational requirements. They correct legacy software inefficiencies to chart a new roadmap for the business.

With a mandate to enable finance digitalization and lead the acceleration of digital transformation throughout the business, the finance function’s ecosystem of IT and finance technologies is the tip of the spear.

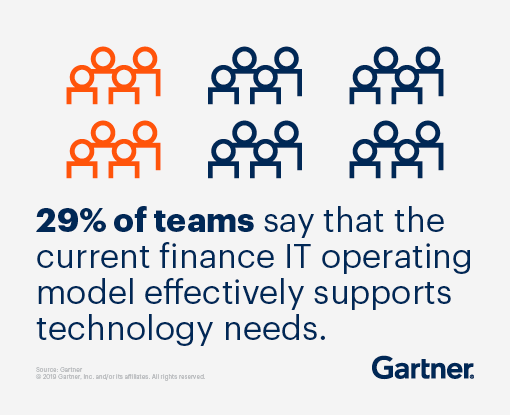

This all requires the right investments. Unfortunately, only a small subset of finance departments are optimized for the breadth and depth of technology investments needed today as seen in the graphic below. Current finance IT operating models aren’t prioritizing the technologies needed to transform the enterprise.

Additionally, the operating model must put into place the talent and procedures to power ROI in tandem with technology. Misguided or unleashed technology integrations without proper processes will doom any transformation effort.

A modernized finance function supported by the right people and processes can drive a range of key financial and operational demands, such as:

- Data cleansing and validation.

- Data analysis and forecasting.

- Finance project management and change management governance.

- Benchmarking.

- Next-generation skills development.

- Shared services alignment.

- Risk management.

- Many, many more.

As the tech stack stands and operates, finance leaders can think strategically about carrying over time savings and key learnings into bigger-picture operational goals, such as:

- Establishing a dedicated Data Analytics Center of Excellence (CoE).

- Experimenting with extended planning and analysis (xP&A) frameworks.

- Integrating microservices and cloud applications into broader finance operations.

- Promoting collaboration and workforce management.

- Refining user experience and service design.

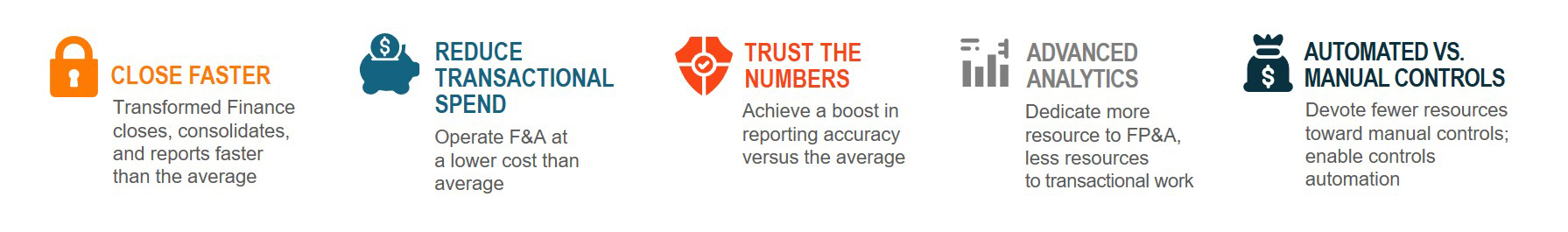

Overall, the finance function spends less time transacting and more time actioning; less time reporting, more time decisioning. This is the hallmark of a modern, high-powered finance function.

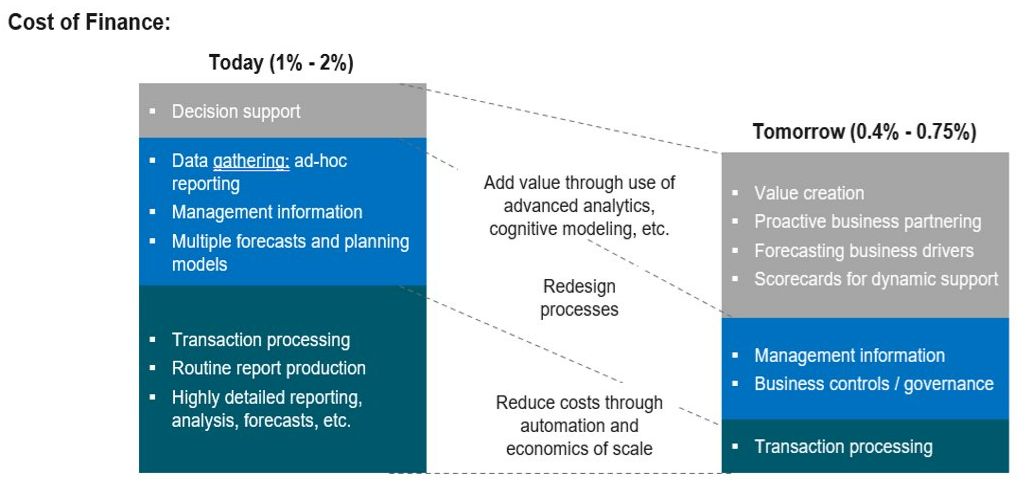

The evolution of finance has reframed the total cost to perform the finance function – for the better. To transform your future, start with today’s finance model.

Contact the finance transformation experts at CrossCountry Consulting to get started on your journey toward a faster, smarter finance function.