Imagine a world where Order to Cash, Procure to Pay, and Record to Report daily activities are mostly automated.

Remaining Finance & Accounting resources in those areas become more focused on analyzing data and continuous process improvement. Other activities that are more variable, tougher to automate, and less business-focused, like Tax and Treasury, are conducted by low-cost centers.

Most Finance resources are focused on FP&A, but FP&A is no longer just a Finance activity. It has evolved into Enterprise Performance Management (EPM). EPM team members work in cross-functional business and technology teams to consistently identify ways to improve pricing, profitability, business intelligence, and other high-priority targets.

This future is not only realistic – it’s here.

However, CFOs are currently in a state of confusion. Finance should operate at a lower cost AND deliver more value – which seems unrealistic.

Today’s Finance Org Is Inundated From All Directions

Finance used to be simple.

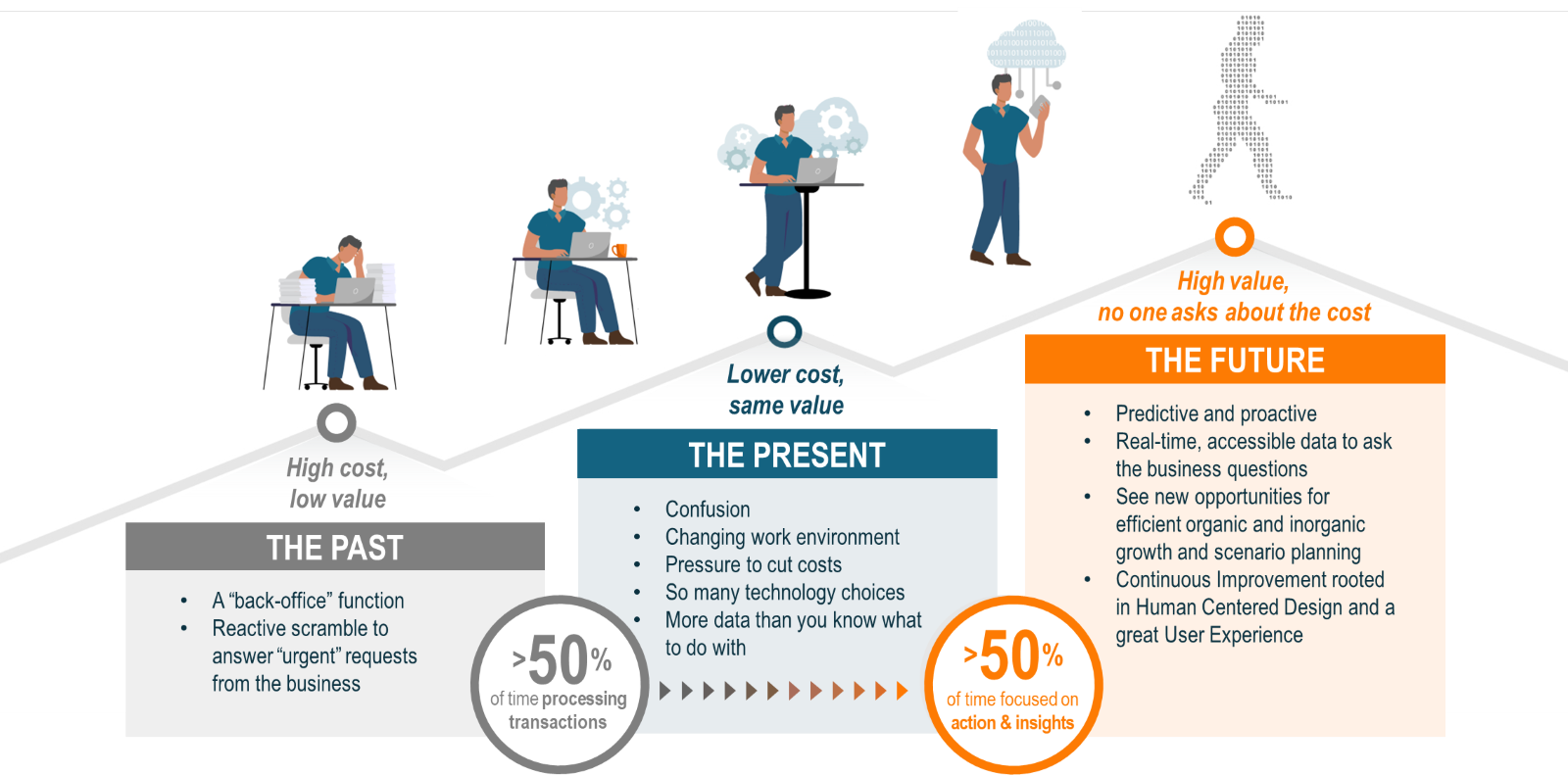

It was a back-office, support function that recorded transactions and reported results. Greater than 50% of an average employee’s time was spent on processing transactions and generating reports. That simplicity also included a high-stress, reactive culture that was always scrambling to answer questions from the business.

Finance looks different now.

CFOs under constant pressure to reduce costs over the years have succeeded at doing just that – but at the expense of some very talented labor. The remaining employees are increasingly working from anywhere but the office, using new tools daily.

But even with better tools, more automation, and more low-cost center use, Finance organizations are still putting out fires. And employees are overworked.

The Future of Finance Comes Into View

The future Finance organization is more strategic and is entrenched in generating business value. No one asks about the cost.

Finance will be the growth engine for the business. Finance will proactively identify and present opportunities for organic and inorganic growth to the business, forecast unfavorable trends, share insights with the business, and fix problems before they occur.

The future Finance employee will focus >50% of their time on actions and insights. They will understand the value of data, how it flows through the system as an asset, and how to use it to improve results.

The value added by Finance will be significant, and the cost will still be low as transactional tasks will be automated or shifted to low-cost centers.

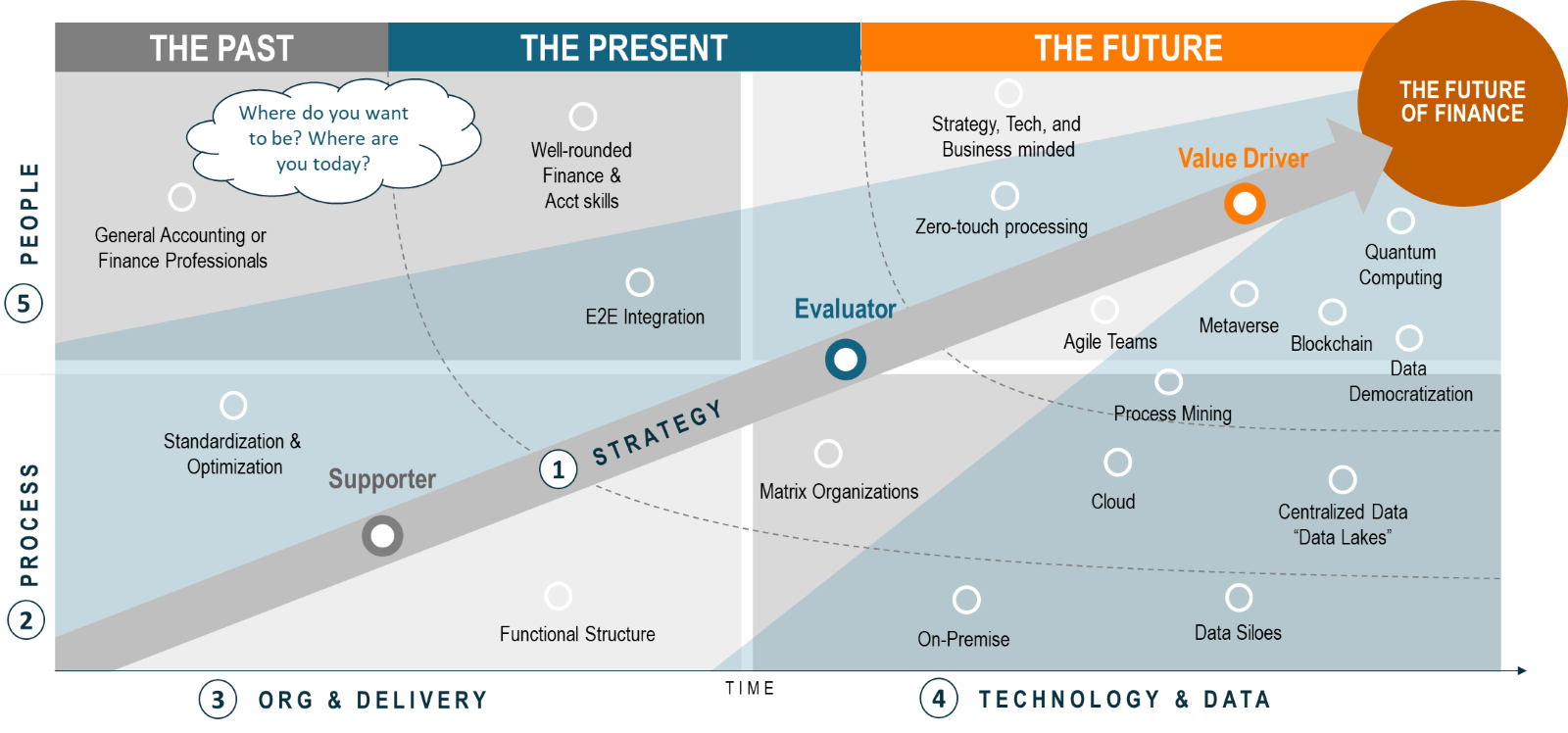

It is a journey to evolve your Finance & Accounting function from “Supporter” to “Value-Driver,” but it doesn’t have to be hard.

How to Make Your Finance Org Future Ready

Becoming future-ready in Finance can be accomplished in six key steps:

- Articulate where you are today and where you want to be in the future – or more importantly where your business needs you to be in the future.

- Take a holistic operating model view that includes process, technology, org., and people.

- Set up a high-performing central transformation office to drive the journey, one that eventually becomes a continuous improvement office that constantly seeks and prioritizes value unlike “PMOs” of the past.

- Start with process. Make sure the right work is completed by the right people – or system/bot – and never automate a bad process!

- Invest heavily in technology but focus investments in automation, analytics, and simple, central data through cloud-based ERPs, data lakes, and APIs.

- Build an agile org. and delivery model that is flatter, and enables faster, more decentralized decision-making in the day-to-day than traditional functional models. Ensure this model is strategically aligned to enterprise priorities

In total, these steps propel the finance org into the future through methodical, measurable transformations. The time to act is now, with the ability to achieve these goals being much closer than firms realize.

For expert support on your future-ready finance journey, contact CrossCountry Consulting.