Leaders preparing to launch a significant international growth initiative have a million tasks on their plate. Scalable financial management software that meets present and future needs is but one – yet it has far-reaching implications for ongoing operations, financial health, compliance, and procurement.

Fortunately, Sage Intacct’s robust functionality and platform experience simplifies complicated transnational reporting, currency, data, tax, and language disparities that finance and accounting teams will encounter. SaaS companies in particular will find valuable use cases for billing automation and revenue recognition, enabling faster, more efficient execution in their growth journey.

All this and more was discussed at Sage Transform 2024, with Sage implementation experts from CrossCountry Consulting leading key discussions on the internationalization of SaaS organizations. Here are some of the core highlights:

Financial Management Challenges International Companies Face

SaaS companies entering a global market for the first time will confront numerous and potentially complex obstacles if their accounting and technology systems are not designed to scale or support international needs. Similarly, companies that already have a global footprint may still be dealing with persistent challenges they’d prefer to finally overcome.

The long but non-exhaustive list of expected challenges includes:

| – Multiple currencies lead to reporting and transactional issues | – Multi-language requirements | – Manually creating transactions to force compliance |

| – Systems and data cobbled together manually | – Requirement-gathering is often incomplete | – Consolidations become more complicated due to FX implications |

| – Tax laws, GAAP, and regulatory requirements differ by country | – Stop-gap solutions become permanent solutions | – Training is undervalued and leads to recurring and unique issues every month |

| – Technology solutions are often regional, requiring upgrades to existing tools or migration to more robust ones | – Systems are looked at in a vacuum (e.g. focus on Sage Intacct only without evaluating impact on upstream/downstream solutions like Salesforce or Lockstep) | – A cross-department problem requires a cross-department solution |

So how can leaders navigate these issues within Sage Intacct?

Identify Accounting Requirements for International Expansion

To make the transition to a successful target state as a global organization, there are two key pillars leaders must keep top of mind: 1) what’s legally required from an accounting perspective and 2) how to address differences in GAAP across multiple countries.

Legal Requirements

The legal requirements for operating internationally are fundamentally different than operating domestically. Finance and accounting leaders should ask themselves:

- What did auditors ask last year? This is a useful baseline to spur conversations about what changes might need to be made in advance of a forthcoming audit cycle. And it can also shed light on the types of providers and third parties that will need to be brought in to support.

- What reports must be submitted to tax and regulatory agencies (e.g., Making Tax Digital)? International requirements may require additional internal and external resources to accommodate, and the Sage environment will need to be specifically configured in a way to allow the proper sharing, visibility, and flow of reporting information.

- What are today’s pain points? For instance:

- Some regions and countries require a unique, sequential number, known as the accounting sequence number, for each posted transaction that affects the general ledger or subledgers.

- Some regions and countries don’t allow deletion of any transactions, especially revenue.

- VAT returns must be submitted electronically directly through the ERP.

- Many countries have specific guidelines for how their invoices must be presented (tax information, language, invoice info, etc.).

GAAP Requirements

The reality of going international is that different countries have different GAAP requirements, such as ASC, IFRS, PCG, and more.

The good news is that domestic accounting teams don’t necessarily need to be experts on all these regulations. Regional teams within the global organization will have more hands-on experience and detailed information on what exactly is needed to accommodate potential accounting changes. User-defined books are immensely useful in this capacity, as they can be adapted and layered to facilitate evolving reporting needs.

Understanding the aforementioned requirements sets the stage for a successful, purpose-built Sage implementation.

Execute an International Deployment: 5 Keys to Success

To remove predictable delays, ensure an optimal outcome, and quickly generate value from Sage, there are five primary focus areas to consider:

1. Define Requirements

- What systems will be impacted by the change?

- What new tax regulations must be complied with?

- Are there new regulatory reporting guidelines?

- Which languages need to be supported in the system?

- Are there new audit requirements?

- What entities will be added?

- Which banking partners will be selected?

2. Create an Achievable Timeline and Stick to It

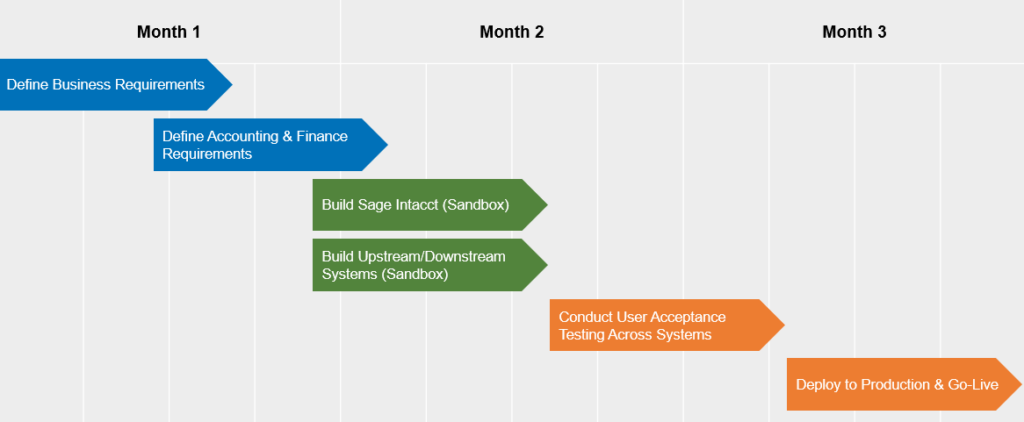

While timelines will vary depending on complexity and scope, here’s a rough snapshot of what SaaS leaders can expect:

3. Get Buy-In From the Right People

- International finance teams (tax, audit, operational finance, FP&A, FX).

- Sales operations and Salesforce development.

- Executive leadership.

- CTOs and systems administrators.

4. Engage a Sage Intacct Expert

Clear communication and close partnership with a Sage Intacct implementation expert like CrossCountry Consulting will ensure the internationalization of modules and existing configurations are completed effectively. As part of the project delivery, hands-on go-live and post-production services can add greater value and ROI to the entire technology lifecycle.

5. Support Teams With Thorough Testing and Training

As a reminder, any software is only as successful as its users, so all relevant staff must keep pace with system upgrades, environment changes, and new functionality before, during, and after rollout. Allow ample time for testing and questions, and create a robust list of test scenarios to track against.

To implement Sage for your unique requirements, contact CrossCountry Consulting.