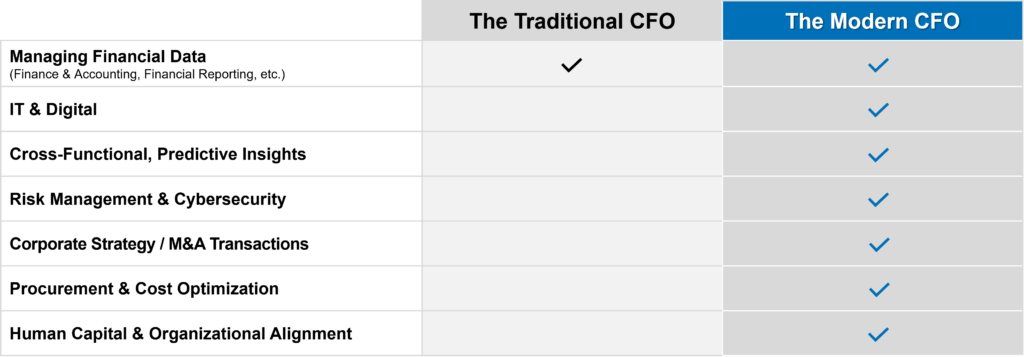

All the trends in the last several years signal the same thing: The CFO’s job is becoming more complex and requiring even greater cross-functional collaboration and ownership of responsibilities. At the same time, data availability is exploding, and reporting and analytics always make their way back to the CFO’s desk.

Tight on time, attention, and budget, how can the modern CFO create value and drive transformation across the enterprise?

It starts with the right reporting and analytics framework.

In close partnership with the CIO and key transformation leaders in Revenue, Procurement, People, and Risk, the CFO can drive successful change outcomes that touch virtually every area of the business – process by process, system by system, data flow by data flow.

Here’s what that looks like.

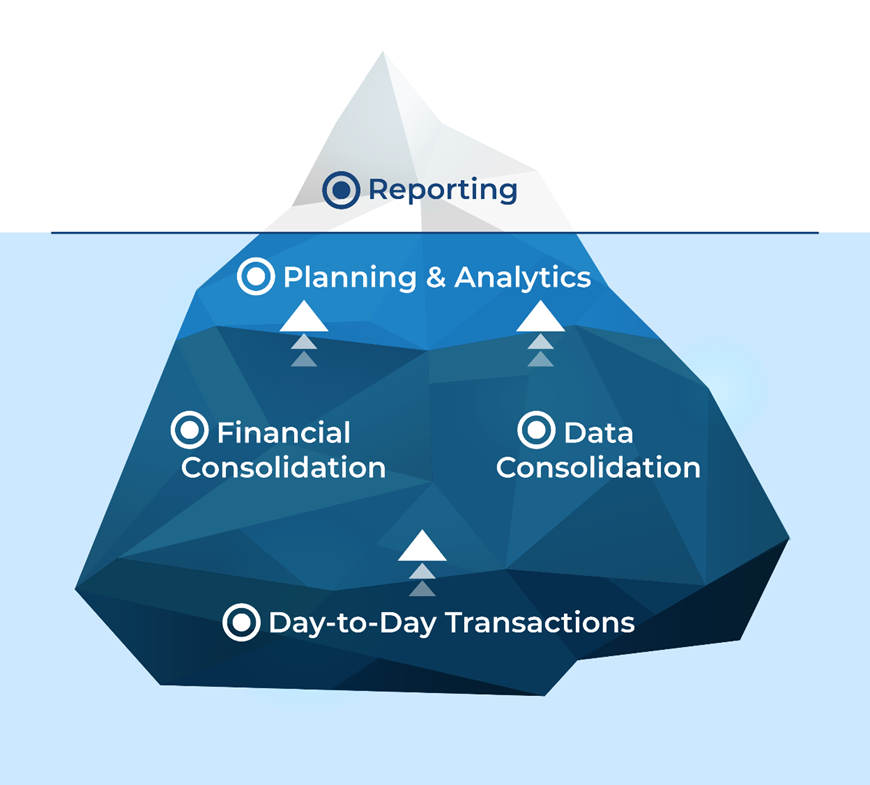

Understanding the Iceberg: Enterprise Insights Hidden Below the Surface

Today’s CFO is being asked to produce enhanced reporting that is a useful predictor of the future. Yet organizations often lack the ability to utilize the component parts needed to achieve necessary insight. To move beyond conventional metrics like sales, expenses, and profits, additional data that hides beneath the surface must be integrated into reporting.

CrossCountry Consulting’s reporting and analytics framework dives deep into the value and cost drivers normally hidden from immediate view. By leveraging component data from across the enterprise, CFOs gain valuable insights into the most critical KPIs.

Conceptualized as an iceberg, the framework systematically helps companies gather, cleanse, consolidate, report, and drive strategic decisions using complex enterprise data hidden beneath the surface.

Each of these layers help today’s CFO dive deeper into organizational data to enhance reporting and drive enterprise-wide value.

Day-to-Day Transactions: Strategy and Process

Starting at the foundational level, processes, systems, and customer-facing apps dictate how accessible, accurate, and complete information will be across the enterprise. Bad inputs result in bad outputs, so it’s critical to optimize processes, implement workflows, and enhance datasets to produce the right insights and drive transformation.

Financial Consolidation: Close Optimization

Aggregate, consolidate, and reconcile financial data to reduce time to close and improve reporting accuracy. Automated finance tools and unified processes drive speed and quality of journal entries, reconciliations, and complex consolidations to produce auditable financial statements sooner than ever before.

Data Consolidation: Connected Enterprise View

Enhanced reporting is achieved through a holistic understanding of an organization that goes beyond general ledger accounting. Sales opportunities, workforce planning, supply chain details, plant management and inventory, and even marketing clicks are all relevant information for a CFO who’s tasked with determining where to invest capital. It’s critical to partner with leaders across the organization to identify your most critical operational KPIs. Connecting to centralized, standardized, and clean data sources provides an integrated perspective to inform strategic planning.

Planning and Analytics: Informed Budgeting and Forecasting

Utilize advanced analytics and actionable, predictive insights to identify trends, enhance scenario planning, and optimize spend. World class, persona-based reporting delivers differentiated insights to key stakeholders in the business and improves the accuracy and effectiveness of budgeting and forecasting. This level of understanding provides the opportunity for CFOs to become valued corporate leaders and drive a strategic finance function.

Transformation as a Competitive Advantage

The CFO’s specialized background in strategic financial management and expanding portfolio of non-Finance activities make them uniquely positioned to be the architects of transformation. While in the past they may have been value-counters, today they’re value-creators.

They make this pivot by:

- Increasing investor and board-level expectations around enterprise insights and non-financial data.

- Defining, cleaning, and governing data that’s historically unreliable or uneven.

- Producing trendlines and advising on strategic decisions using more accurate forecasts.

- Moving away from historical views to a predictable future.

- Addressing Finance and IT siloes to clarify data ownership.

- Accelerating close cycle times by removing FP&A and Controller siloes.

- Upskilling Finance talent with data engineering, dashboarding, and other digital capabilities.

All of this is made real with a reporting and analytics framework that optimizes key enterprise processes and datasets to achieve:

- Automated, accurate, connected data.

- Real-time daily close.

- Visual, integrated dashboards.

- Predictive and prescriptive analytics.

Armed with these advanced capabilities, the CFO can lead from the front, in the boardroom and in the market, and be the driver of enterprise-wide transformation.

Ready to make the leap to strategic finance? Contact CrossCountry Consulting today to explore how our proprietary framework can enable your organization to harness the full potential of your data.