Today’s CFOs are scanning the AI technology landscape to build a portfolio of AI tools, applications, integrations, and custom functionality that can elevate employees and drive a competitive advantage through the back office. In fact, it’s the top investment priority for CFOs in 2024.

There’s no shortage of options to choose from, even for smaller or mid-sized companies without internal resources that are more likely to buy externally. So where are Finance leaders finding AI value?

Transformation experts from CrossCountry Consulting attended a recent AI Investor Summit+Showcase, presented by Microsoft and hosted by the Technology Alliance, to gain deeper insights into emerging AI breakthroughs and capabilities. The multi-day event spotlighted AI applications across a range of subjects and industries, including climate, medical, and defense. As one of the primary leaders of enterprise digital transformation, the CFO is the key executor of these kinds of AI innovations.

Here are some of the principal ways the CFO is putting AI into action.

AI Across Key Modern Finance Activities

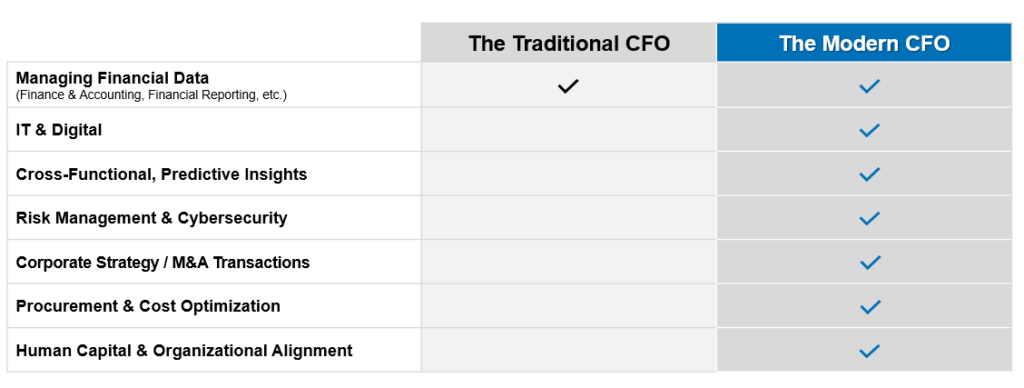

More than ever, Finance is busy supporting or leading non-financial activities. Fortunately, technology can bridge the gap between limited capacity and maximum impact.

While the following use cases and tools in no way represent preferred recommendations or partners, they do provide a mix of technologies designed to solve a range of common CFO challenges.

Generating financial reports from source documents

Move away from rote data compilation, transactions, and preparation by leveraging AI to source, extract, and create content in key financial reports.

- Trullion: Automate the extraction of leasing contract terms based on policies to calculate financial results.

- Klarity.ai: Extract contracts for technical accounting review and ingest into a revenue calculation tool.

- Snowflake Cortex: Conduct a universal search of database components within Snowflake to extract key fields from sales orders, purchase orders, and contract data. Utilize this information for billing, business intelligence, or transactions in an ERP.

Creating content for external and executive reporting

For standardizing templates and accelerating time-to-presentation within Microsoft or Google product suites, there are now native functionalities and easy integrations any business can capitalize on.

- Microsoft CoPilot embedded into PowerPoint/Word to create CFO, Board, and Investor decks and improve employee productivity.

- Google Gemini embedded into Slides/Docs to improve productivity.

Investor Relations

- Q4, Inc: Search, navigate, and summarize all workflows and data in an investor relations (IR) program, including customer relationship management (CRM), engagement data, and ownership information.

Corporate Development and Strategic Finance

- OneStream: A unified performance management platform that utilizes its Enterprise Finance AI solutions to automate workflows, develop forecasting scenario models, and detect anomalies in data for normalization.

- AlphaSense: A financial industry AI solution to research market trends and inform M&A strategy or GTM planning considerations.

- Daydream: An AI-powered business intelligence platform that connects context and discussion to the data analysis used for key metrics.

Reconciliations and fluctuation insights

Expedite transactional finance activities and surface more insights.

- FloQast: AI to generate flux commentary in the account balance reconciliation tool with easy integrations to your favorite reporting tools like Workiva.

Other common tools like Numeric and Blackline offer adjacent capabilities.

Featured Insight

Accounts Payable and Procurement

Drive Procure-to-Pay (P2P) excellence with innovative AI solutions.

- Coupa: New accounts payable (AP) automation features digitize invoices by extracting invoice data from scanned documents. To further reduce the need for manual entry, these features also automatically assign tax code rules to invoices.

- Tropic: Streamline employees’ buying experience by providing them with intelligent intake orchestration and guidance for making smarter buying decisions.

- Vic.ai: This AI-powered autonomous finance platform manages end-to-end AP management from invoice ingestion to payment processing.

Automated workflows via simple prompts

Maximize prompt engineering to make dashboarding, visualizations, and workflow management more seamless.

- Alteryx AiDIN: Automate workflows and draft summarized analytics via simple prompts. Use for automating complex journal entry calculations, cash reconciliations, or ASC 606 SSP modeling, among other capabilities.

- Microsoft’s CoPilot embedded in PowerBI automates the creation of dashboards via simple prompts for generating insights and predictive analytics. These outputs can then inform forecasting, flux analysis, and error detection monitoring.

- Microsoft’s Copilot embedded in PowerQuery or Excel can be used for simple prompt-driven data cleansing, modeling, and insights.

Fraud, collection, and bad debt

Uncover insights and anomalies in collections, billing, and payments.

- Highradius: GenAI for debt collection to accurately predict customer payment delays 30 days in advance. It also informs credit check processes via credit scoring.

- Forter: Generate actionable insights to better understand customers, fraud patterns, and payment trends.

Building a customized GenAI for an enterprise

- Dataiku: Platform for internal business leads, data scientists, and engineers to collaborate and develop custom GenAI applications in an easy-to-navigate controlled environment.

During the AI Investor Summit+Showcase, the following new AI startups were pitched, adding to the expanding list of options for today’s leaders:

- KredosAI: Payments and collections tool for complex dunning processes centered around ideal customer experiences.

- OutboundAI: Specialized chatbots to automate the complex healthcare telephonics system.

- Codified: Data access governance for a single source of truth for data policies, audit trail, and authorization across an enterprise.

Getting Started on the AI Journey

It can be difficult to navigate the technology decision-making process and its impact on the organization’s operating model, people, systems, and processes. Determining overarching strategy, weighing options, conducting benchmarking, analyzing ROI potential – it must all be completed through a structured transformation management playbook.

CrossCountry Consulting takes an orchestrated, continuous improvement approach to defining and mobilizing AI success for companies. Recommendations are based on best practices and hands-on expertise with today’s leading technologies and industries. To identify AI’s integration potential with your organization, contact CrossCountry Consulting.