Imagine getting a mobile notification that the rates of one of your top technology vendors were just reduced. Clicking on your mobile app, you now see that your annual cost savings have increased, your forecasted IT spend is now favorable to budget, and more money is available for other strategic investments.

This is a great example of Plan-to-Pay working in harmony, empowered by an “iceberg” like reporting and analytics framework where the strategic insights are at your fingertips, and all the necessary connections happen beneath the surface.

Why Plan-to-Pay?

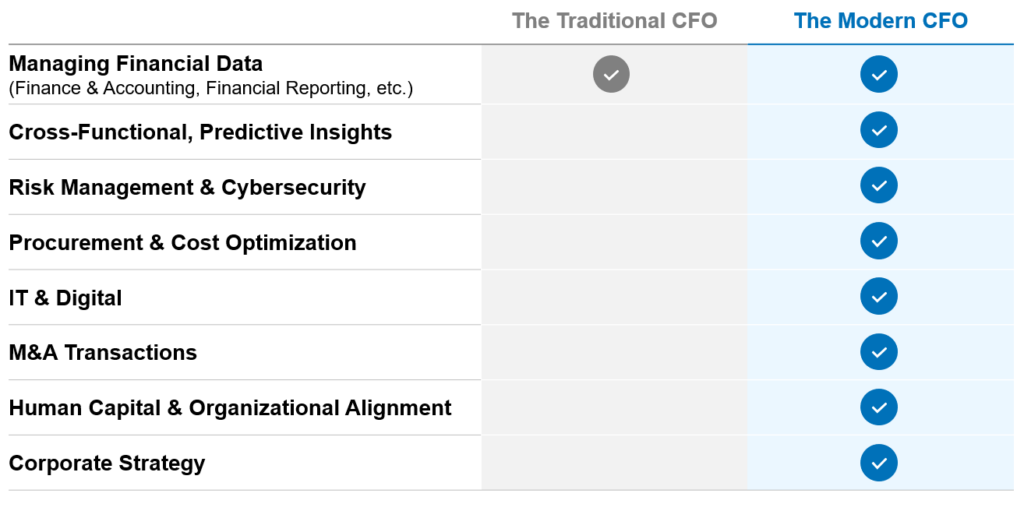

The role of the CFO is expanding. 43% of CFOs are leading enterprise strategy and transformation initiatives. The CFO is often leading Procurement and IT – or at least has oversight of the key decision-maker for respective departments. This all comes in parallel to the CFO roles of managing the company’s investments, balancing risk, and leading M&A activity. Doing all of this in an uncertain economic climate is of course a lot for one person to manage.

Most CFOs (59%) say that cost reduction is currently their top strategic priority, but that they still need to balance cost improvement with investments in value creation given board pressure to experiment with opportunities like generative AI. Not to mention, there’s huge pressure to protect the company from cyber threats and other risks.

High interest rates make it difficult to leverage the debt market – meaning investments must come from cash – putting additional strain on not only generating cost savings but also on making sure those Procurement savings actually reach the bottom line and can be redeployed effectively.

To achieve this, organizations need integrated functional teams aligned on strategic objectives, speaking the same language and planning their respective actions accordingly.

This integration enables:

- Improved predictability through higher forecast accuracy throughout the year.

- Stronger reporting for faster, more agile decision-making, allowing leaders to respond instantly to internal and external factors.

- Dynamic budgeting, forecasting, and cost reallocation in real-time to capitalize on investments in growth, innovation, and technology.

- Opportunistic action as the Plan-to-Pay system identifies opportunities when spend plans change. Finance can take immediate action rather than looking backward after the opportunity is closed.

- Realization of bottom-line savings from Sourcing and Procurement activities, creating freed-up cash.

- Improved data-based controls that deliver greater operational consistency.

One way to go on offense is building a Plan-to-Pay capability. You may have robust planning and Procure-to-Pay processes, but they are often disjointed in that:

- Procurement is not viewed as a strategic stakeholder in the planning and forecasting processes, thus limiting their effectiveness in driving toward strategic outcomes on the backend.

- Investments and cost savings “go get” happen annually versus in real time.

- Category-level third-party spend can’t be easily located in financial statements or tied to transformation initiatives or investments.

Plan-to-Pay integrates Finance and Procurement in exciting new ways, bringing together your people, process, technology, and data. This business-centric approach (as opposed to department-specific) enables all parties to operate more efficiently with stronger outputs.

The Nuts and Bolts of Plan-to-Pay

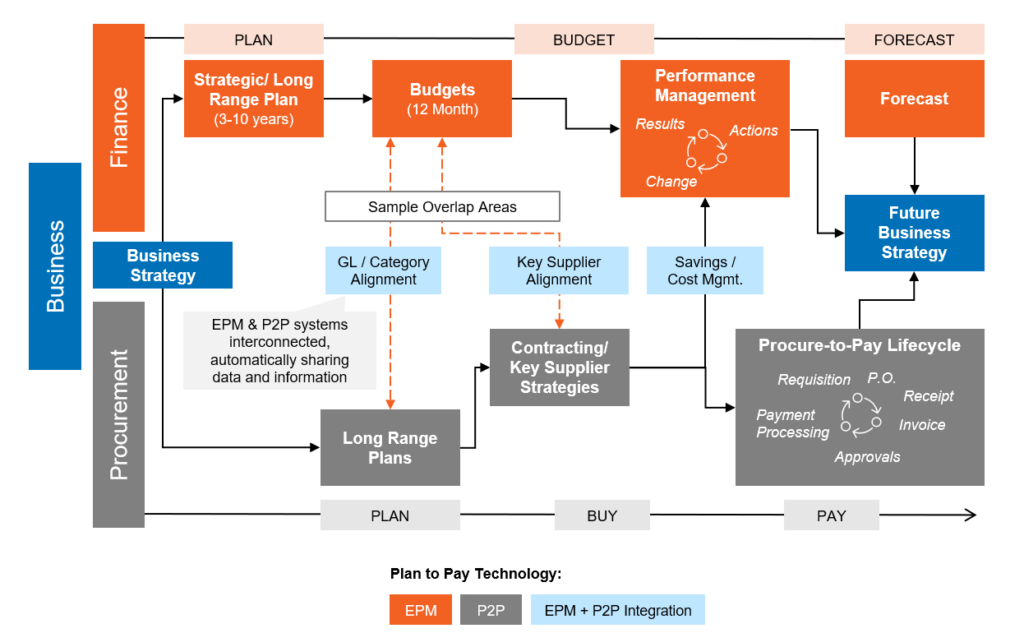

Plan-to-Pay goes beyond Sourcing and Procurement frameworks by connecting the full planning lifecycle of the Finance team with Procurement and respective budget owners for one comprehensive operating model. This means there’s consistent throughput, forethought, and improvement before, during, and after common Plan-to-Pay cycles with stronger inputs, faster delivery, and an integrated system of events across cross-functional teams.

This business-centric approach to delivering collective Finance and Procurement value is illustrated below:

Built on a core platform of Procurement, spend management, ERP, EPM, and cloud data management tools, the Plan-to-Pay lifecycle integrates, governs, and accelerates enterprise value through key capabilities:

- Planning: Long-range planning is the engine that drives all functions. Finance drives budgeting, which feeds the Procurement plan. Finance is then embedded into active budget reduction. Rather than working in silos, Finance can challenge and enhance Procurement’s demand assumptions.

- Category and vendor management: Procurement develops category strategies in collaboration with Finance and other functions to deliver at an optimal total cost of ownership (TCO).

- Source-to-Pay: Sourcing teams engage the supply base to consolidate spend and optimize contracts, while Finance is tasked with capturing these tangible cost reductions via chart of accounts, operational reporting dimensions, and budget updates.

- AP/Payment: Actual savings delivery is tracked and captured through invoicing volume, with Finance appropriately reducing corresponding forecasts monthly or quarterly as savings are realized.

- Technology enablement: The ERP, EPM, and S2P systems are interconnected, providing digital automation, simplified user experience, and mitigated supplier risk. Tools like Coupa and OneStream can power the end-to-end process.

Value Delivered with Plan-to-Pay

Plan-to-Pay generates enterprise value in the form of:

- Cross-functional alignment and accountability: One source of truth runs through an integrated, agile process that’s tied to the strategic plan and annual budget. With this framework, Finance, Procurement, and business leads conduct planning together, jointly enforcing and governing the impact.

- Continuous cost and investment control: Real-time visibility into cost savings progress and the ability to pool and deploy those savings to alter budgets makes Plan-to-Pay incredibly responsive to business and market demands. Leaders can update forecasts and make appropriate investments (vs department-centric decisions) more quickly and confidently.

- Faster reporting cycle times: Linked GL code and vendor taxonomies between multiple systems improve accuracy and ability to influence spending because of consistent terminology and reporting dimensions.

- Optimal G&A: At a time when it’s difficult to attract and retain talent, integrated and automated processes reduce the need for transactional roles.

- Culture of continuous improvement: Plan-to-Pay turns Finance and Procurement teams into interconnected systems, which thrive on integrated decision-making, and are constantly exploring ways to further improve the organization.

The Technology That Enables Plan-to-Pay

Technology is the catalyst to high-functioning Plan-to-Pay processes. While value is still available, you can’t achieve the speed, agility, and higher efficiency that symbolizes Plan-to-Pay without the right connectivity through tools.

- S2P systems like Coupa provide all vendor, spending, and contracting information.

- Finance EPM systems like OneStream house budgets, forecasts, and financials.

Connecting data to EPM and S2P systems is the key to Plan-to-Pay value generation. The integration and automation of these systems creates opportunities to spend more time on insights than analysis, thus enabling Plan-to-Pay.

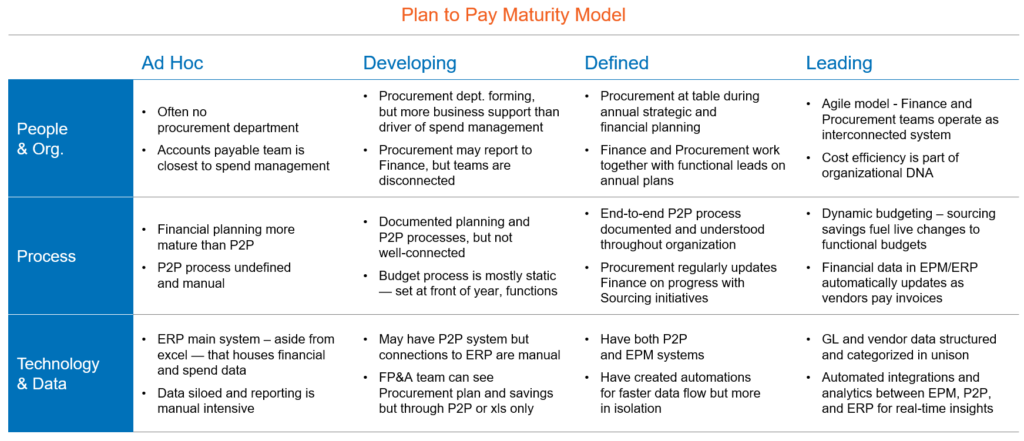

How Can You Get Started?

Getting started is easy. CrossCountry Consulting brings together all key Finance, Procurement, IT, and select budget/functional stakeholders for 1-2 days to:

- Agree to current state Plan-to-Pay maturity.

- Vision the desired future state.

- Identify and prioritize gaps and initiatives.

- Build an action plan and agree on owners to execute.

We accomplish this first step with high velocity through a proprietary transformation management solution, which harnesses future-back and design thinking to solve complex problems in tangible ways.

This approach is beneficial because it’s:

- Faster and more affordable than other transformation methods.

- Better at getting the best ideas on the table and securing buy-in.

- More interactive and candidly more fun.

CrossCountry Consulting’s integrated Procurement, Finance, FP&A, and IT transformation experts help strategize and implement Plan-to-Pay models end-to-end, including the processes and technologies required to truly integrate enterprise planning.

To learn how Plan-to-Pay can work for your organization, contact CrossCountry Consulting today.