The alliance between the CFO and CIO is the cornerstone for successful digital transformation. Rather than address financials and technology separately, these leaders can leverage their combined strengths to drive competitive advantage and generate substantial value.

So how can organizations achieve this synergy? It starts by understanding the importance of collaboration and the actionable steps to achieve strategic finance transformation.

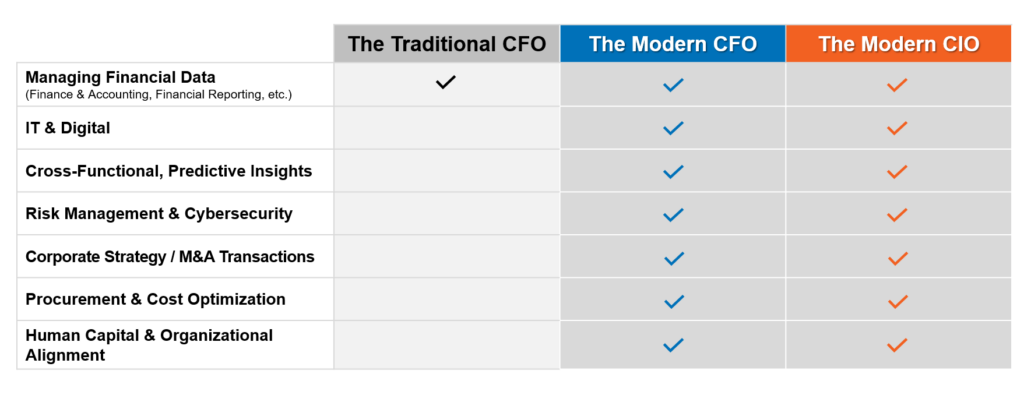

The Evolving Roles of the Modern CFO and CIO

Over the past decade, the roles of the CFO and CIO have undergone significant change. The modern CFO is no longer confined to traditional financial management; they’re now pivotal in leading digital transformation efforts. According to a Forrester Consulting survey commissioned by CrossCountry Consulting, 95% of finance leaders believe that a close and strategic partnership with IT counterparts is essential for successful digital transformation. Despite this, 65% of finance leaders acknowledge a silo between finance and IT, with only 30% describing their relationship with IT as strong.

The responsibilities of the CFO have expanded to include producing enterprise insights from both financial and operational data, overseeing cybersecurity, driving corporate strategy, and optimizing costs. These tasks necessitate a deep understanding of technology and data analytics, making collaboration with the CIO indispensable.

Similarly, the modern CIO’s role extends beyond managing IT infrastructure. CIOs are now integral to corporate strategy, participating in operating and risk committees and aligning IT strategy with business objectives. This evolution requires CIOs to work closely with CFOs to ensure that technology investments align with the organization’s strategic goals and deliver measurable ROI.

Elements of a Strategic Partnership

The partnership between the CFO and CIO is crucial for organizations to optimize processes and reporting, enhance data analytics capabilities, and improve decision-making. There are four key elements of digital transformation where CFOs must align with their CIO peers.

- Data analytics: CFOs are under pressure to provide real-time, predictive analytics that extend beyond traditional financial reporting. Achieving this requires robust processes, quality data, and a clear strategy. By working together, CFOs and CIOs can ensure that data from various sources is integrated and analyzed effectively, providing valuable insights that drive business strategy. For instance, interconnecting datasets from workforce planning, sales, inventory management, and supply chain operations can identify trends and inform strategic decisions. This level of data consolidation enables CFOs to provide a comprehensive view of the organization’s performance and future prospects, enhancing their role as corporate strategists.

- Enterprise architecture: A well-defined enterprise architecture encompasses business, data, application, and technology architectures to ensure all elements work together seamlessly. The CIO designs and maintains this architecture, while the CFO ensures investments align with the organization’s strategic goals. Serving as the blueprint for the structure and operation of an organization, enterprise architecture aligns business processes, data flows, applications, and technology infrastructure to support strategic objectives. This holistic view allows organizations to optimize operations, reduce redundancies, and ensure technology investments deliver value. Integrating various systems and data sources through a robust enterprise architecture framework provides a unified view of operations, which is critical for accurate financial reports, operational insights, and strategic plans.

- Risk management: Risk management, particularly cybersecurity, is another area where the CFO-CIO partnership is essential. CFOs must understand the financial implications of cybersecurity threats and investments, while CIOs protect the organization’s data and systems. Together, they develop a robust business continuity plan to minimize risks and ensure resilience. Protecting the organization’s “crown jewels” – its critical data and assets – involves regular threat assessments, penetration testing, and advanced threat detection technologies. Incorporating robust risk management practices into the operating model is crucial for maintaining reputation and revenue in the face of external threats.

- Operating model: The operating model defines how an organization delivers value to its customers and stakeholders. To embrace digital technologies and enhance organizational agility, conventional operating models must change. Today’s IT departments must be deeply integrated into business operations, requiring a new operating model where IT and business units collaborate closely, with IT personnel embedded within business teams to understand and address specific needs. Adopting an agile operating model allows IT teams to work in short, iterative cycles, delivering updates and improvements continuously. This approach ensures technology solutions align with evolving business requirements and can adapt quickly to market changes. An optimized operating model, supported by a well-defined enterprise architecture, enhances operational efficiency by ensuring streamlined processes, effective data management, and scalable, adaptable technology solutions.

Actionable Steps for Strengthening the Partnership

To foster a strong partnership between the CFO and CIO, organizations can take several practical steps:

- Define clear strategic initiatives: Ensure that corporate, finance, and IT strategies are aligned. This alignment informs the IT roadmap, digital transformation initiatives, and organizational priorities.

- Form cross-functional teams: Create teams that include finance and IT business partners working together. These teams can tackle specific projects, such as developing data analytics strategies or improving key performance indicators (KPIs).

- Drive velocity: Adopt agile methodologies to manage projects. Agile frameworks, with product owners and scrum teams, can accelerate digital transformation efforts and deliver value more quickly.

- Manage change effectively: Proactively manage change by setting clear expectations, providing training, and communicating the benefits of new tools and processes. Effective change management increases adoption and reduces resistance.

- Measure success: Establish KPIs and OKRs for all transformation initiatives. Regularly review progress to ensure that projects are on track and delivering the expected results.

The Path Forward

The partnership between the CFO and CIO is a powerful driver of strategic finance. By working together to integrate enterprise architecture, risk management, and the operating model, leaders can create a resilient, efficient, and agile organization.

To promote greater finance-IT collaboration and drive enterprise transformation, contact CrossCountry Consulting.