The days of private equity funds financially engineering positive returns are over. Amid challenging market dynamics, sponsors and portfolio company CFOs – particularly in the middle market – need a more tactical playbook to drive value starting early in the hold period.

Increasingly, they’re turning to strategic technology levers to deliver optimized cost structures, operational efficiencies, and increased EBITDA margins.

What Is Technology-Enabled Value Creation, Really?

Technology-enabled value creation is the identification, evaluation, prioritization, and execution of technology initiatives that improve enterprise value for maximum deal returns. By creating a scalable, purpose-built technology and data infrastructure, companies can subsequently improve key functional processes and enhance revenue-generation capabilities within a rationalized cost environment.

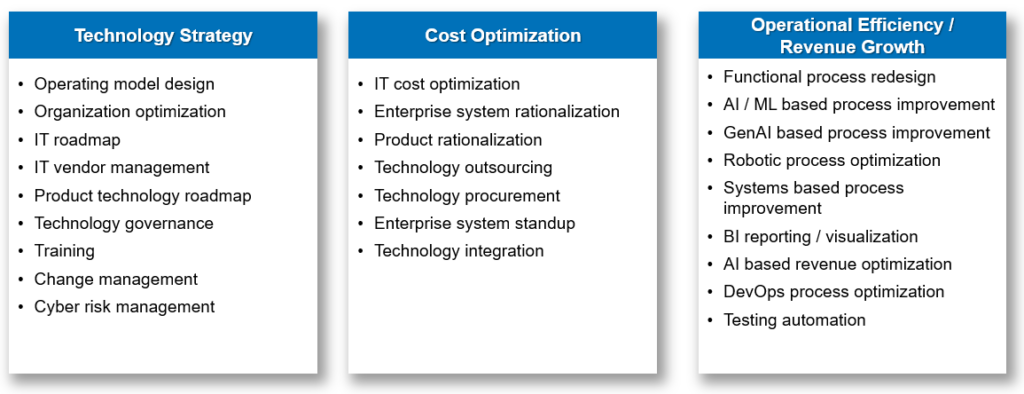

These initiatives take many shapes but generally comprise some of the examples below:

Because value creation is not one-size-fits-all, the specific technology enhancements that are implemented can be dialed up or down to meet the exact needs of a company within its investment lifecycle. The goal is to pragmatically select technology initiatives that unlock newfound value early in the hold period and allow sponsors to demonstrate financial impact and then realize those gains upon exiting the transaction. This is especially important at smaller firms without an existing Office of the CIO or CTO.

Depending on the size of a given portfolio company, there may not have been a dedicated IT decision-maker with the background and expertise to transform operations starting with a technology-first mindset. Even now, in middle-market PE portfolio companies, it’s often the CFO who must lead digital transformation efforts, adding to the expanding and ever-complicated scope of responsibilities put on their desk.

Why Now?

Three principal factors are motivating PE firms to invest more heavily in value-creation projects anchored in technology solutions:

- Interest rates are up, perhaps for longer than most expected.

- Valuations are down from their highs in 2022.

- Pressure from limited partners is growing. After several years of light deal volume, it’s time, as the sentiment goes, to put capital to work.

Earnings growth – more than margin or multiple expansion – must drive PE value creation moving forward, which technology can help unlock. As such, sponsors are digging deeper and experimenting with new or previously ignored mechanisms to capture value despite market forces.

Most importantly, PE firms are leveraging more robust value-creation teams. Firms with internal or external value-creation resources are expected to deliver 0.44X higher multiple on invested capital (MOIC) than those relying on only deal teams. This competitive advantage will drive 5% higher net internal rate of return (IRR) over a 5-year hold period.

To achieve these value-creation objectives in partnership with the right team, a comprehensive technology assessment is a good place to start.

Technology Assessment: Baselining Opportunities for Future Value

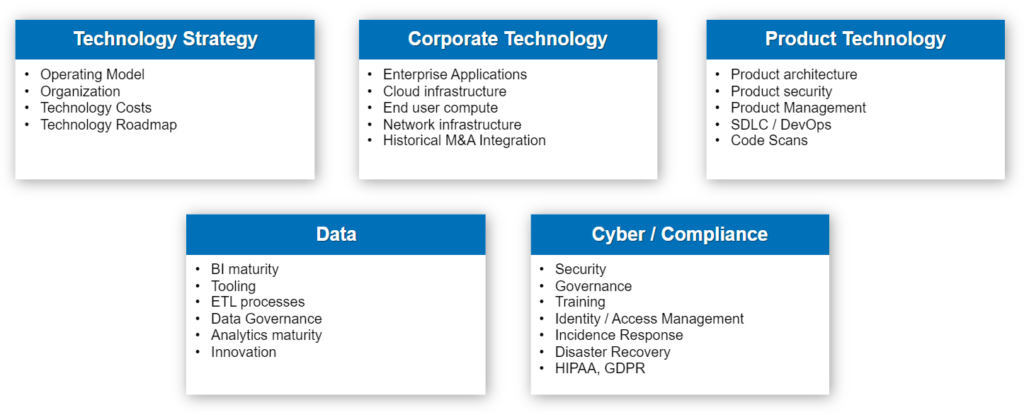

Of the thousands of applications and cloud services in use across the average organization today, where should leaders be focusing their time when trying to locate and realize savings and efficiencies within the technology architecture?

Generally speaking, there are five core technology buckets to consider:

Conducting a technology assessment quickly identifies key findings, risks, and synergy opportunities that will inform and shape the technology value-creation roadmap. It’s important to note that all actions defined and executed as part of the overall technology roadmap should be in alignment with the sponsor’s deal thesis.

For expert support creating CFO-led value across the enterprise, CrossCountry Consulting’s private equity specialists provide hands-on operating and implementation advisory to sponsors and portfolio companies at all stages of the investment lifecycle.

To drive value creation in today’s deal market, contact CrossCountry Consulting.