As one of the primary architects and agents of digital transformation across today’s enterprises, the finance function has a two-step charter:

- Internally transform the finance department by acting as the tip of the spear for the rest of the business. This means experimenting, vetting, and implementing leading analytics, automation, and artificial intelligence (AI) platforms that remake day-to-day finance activities and upskilling staff to perform higher-value tasks that meaningfully contribute to the strategic vision of the company.

- Take the lessons learned from re-ordering its own department outward to other business functions. Finance must serve as a trailblazer and shepherd the holistic adoption of tools and processes throughout the enterprise with the goal of greater digital maturity and agility.

Collectively, this requires finance to lead from the front. It must incubate successful practices and technologies on behalf of the business, then compound those wins through strategic cross-functional deployments and integrations.

Easier said than done.

Step 1: Internal Transformation and Innovation

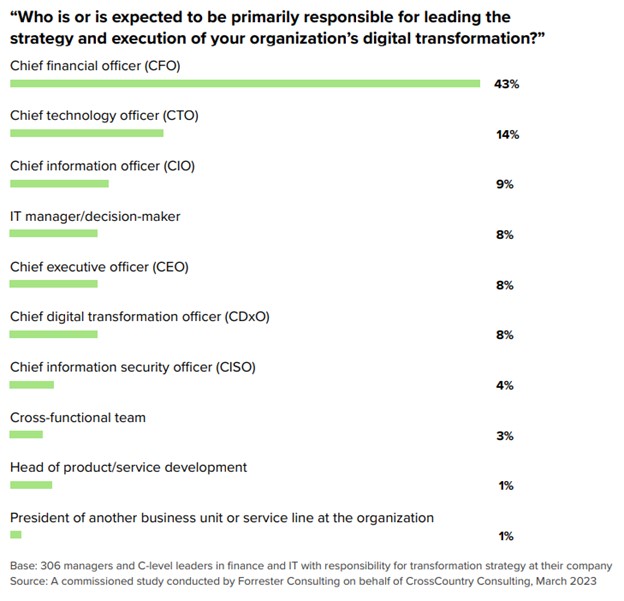

In a Forrester Consulting survey of 300+ senior finance and IT executives commissioned by CrossCountry Consulting, 43% of respondents indicated the CFO is the driver of digital transformation, more than triple the next stakeholder.

With this responsibility, the first component to leading enterprise digital transformation is for finance to advance digital progress within its own house. Broadly speaking, that refers to:

- Automating manual processes: Process standardization and simplification of daily manual activities, such as invoice processing, reconciliation, and budgeting, through robotic process automation (RPA) frees up critical labor hours that can be better spent innovating and strategizing on behalf of the business. Finance’s ability to move away from rote number-crunching is a blueprint that can be replicated in other business units.

- Leveraging data management practices: Cloud data warehousing, the top benefit of digital transformation for 19% of surveyed organizations, is a critical advancement for finance and IT teams. Other data management practices, such as master data management (MDM), data governance, and data visualization, move the needle on what’s possible with the massive amounts of data organizations carry. A holistic data strategy underpins finance’s relationship to the rest of the business and sets the foundation for migrating respective teams onto core systems.

- Deploying advanced analytics and data insights tools: Real-time reporting, predictive insights, and strategic financial planning and analysis (FP&A) are made possible through enterprise performance management (EPM) tools. EPM tools offer the most important benefits of digital transformation according to 13% of respondents. With newfound insights that are easily accessible and drillable, the CFO can make informed decisions quickly, enabling them to see the organization’s path forward more clearly than other stakeholders.

- Embracing progressive technologies: AI and business intelligence (BI) tools are key focus areas for 77% of finance and IT leaders at “high maturity” organizations. Shifting to a technology-enabled culture that is ready to evaluate and onboard new technology platforms as they come onto the market empowers workers to use technology as a force multiplier in their work and impact.

See what 300+ Finance and IT executives say about the state of enterprise digital transformation.

New Forrester research commissioned by CrossCountry Consulting

These actions generate tangible benefits to finance internally, thus validating finance’s leadership in piloting new ideas. But they also contribute significantly to the business, again substantiating the direct line between finance transformation and enterprise transformation. This allows finance to have an outsized impact on the business, including in areas not traditionally in its scope, such as:

- Investor relations.

- Environmental, social, and governance (ESG).

- Investment priorities.

- Service design.

- Retention and employee experience.

- Technology and systems implementation.

- Capital markets/business deals.

Possessing a trove of financial and operational data, the finance function has the capability of seeing under the hood and seeing into the future. Finance’s current digital maturity is a benchmark against which other departments can measure themselves and, over time, advance in unison.

Step 2: Impactful Collaboration and Vision

Even for leading finance teams, it is not enough to simply knock on the door of the CRO, CIO, CTO, COO, or other key executives and expect immediate, productive partnership in enterprise digital transformation. These departments may have their own agendas, systems architectures, employee cultures, and understanding of their place in the company hierarchy.

Finance must intentionally and strategically build a business case for collaboration with these teams, assemble a coalition for change, and align the momentum of this effort to the five-year strategy. Doing so empowers the organization to:

- Increase alignment and digital collaboration: 95% of finance and IT leaders agree that for digital transformation to succeed, it’s important their business units establish a close and strategic partnership. 45% cite the absence of operational alignment as a critical barrier to partnership, though. Digital progress at the enterprise level must be first rooted in the alignment of departments.

- Maximize the adoption and impact of digital tools: When finance has the broader vision to implement tools with use cases beyond its own department, it has a running start on getting the rest of the organization on board with the same or similar platforms. Through a cross-functional Transformation Management Office (TMO) or Center of Excellence (CoE), finance can carry its digital momentum forward in a systematic, measurable way that drives accountability and adoption of digital tools.

- Rationalize technology systems and vendors: The most common digital priority (53%) for finance and IT leaders is the upgrading, replacing, or consolidating of legacy applications or systems. To avoid technology bloat and redundancies, it’s imperative that all functional and business leads provide transparency into existing technology spend. Finance and IT specifically can comb through the thousands of tools in place and identify overlapping capabilities and unnecessary customization with the goal of migrating the organization to an efficient set of core digital tools. This ensures the enterprise systems architecture works for the organization, not against it.

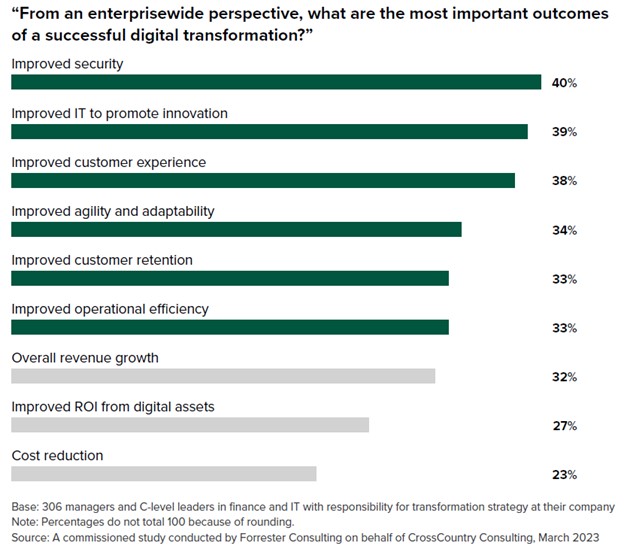

- De-risk: Improved security (40%) is ranked as the most important outcome of digital transformation. The expanding risk universe (regulatory, cyber, economic, competitive, etc.) necessitates a strong, responsive security and innovation posture from organizations. Finance’s partnership with the CRO and CISO in particular is vital when evaluating which technologies and controls can best thwart attacks and risk vectors.

- Manage growth in strategic areas: Some areas of the business are better positioned to digitally transform due to the availability of advanced technologies like AI, BI, and machine learning (ML). Additionally, investment in certain functions might be key to the five-year plan, meaning it’s natural for some business units to make digital progress faster, by design and necessity. Finance’s experience with making the jump to greater digital maturity is a roadmap for high-growth, high-innovation areas of the business, with digital transformation serving as a critical lever to achieving corporate growth objectives.

- Build a value-based cost structure: In a period of rising expenses and borrowing costs, right-sizing the business is critical to starting, maintaining, and reinforcing transformation that takes several years to materialize. 64% say it will take two or more years to see meaningful results from digital transformation. Meanwhile, 23% are using digital transformation explicitly as a cost-reduction effort. To build a durable cost structure that generates short- and long-term results, all business units must be aligned.

- Identify new business opportunities: Enterprise transformation instills common operating rhythms between departments, enabling key business units to ideate, innovate, and execute cohesively and collaboratively on the same wavelength. This collaboration marshals additional resources in the pursuit of new business opportunities, whether that’s IPO, M&A, or other forms of expansion.

- Be intuitively change-ready: The cultural shift to becoming a change-ready, future-ready organization is less measurable but equally impactful. If today’s transformation takes years to generate results, what about the next transformation and the one after? There isn’t a clear starting and stopping point when engaging in concurrent or successive transformation initiatives that impact the entire enterprise – the fog of change is a reality in an environment in which change is expected and accepted at any time. As cross-functional systems and shared processes begin to enable speed, agility, and digital maturity, the entire workforce is resilient and adaptable to change curves.

Finance’s growing charter is more critical than ever. Successfully moving the organization toward a digitally mature future state will take years, but there are key incremental wins along the way that can pile up quickly and deliver meaningful results. The best time to get started is right now.

For more expert insights on the state of finance and IT’s transformation partnership, download the full study. And to expedite your next transformation, contact CrossCountry Consulting.