The finance function – or the Office of the CFO (OCFO) – has historically played a shifting role in the management, authority, and control of enterprise operations.

With roots dating back millennia, early conceptions of finance don’t look all that different from more contemporary finance operating models.

The Traditional Finance Function

The finance function of past decades centered around paper-based manual transactions and processing. It arranged the procurement of new financing, accounted for various forms of operating capital, and contributed to the handling of legal matters.

Broadly speaking, finance, tax, and treasury were the three core functions.

Depending on the size of the firm and the operating model in place, the finance function may have held additional responsibilities including insurance, investments, and risk management.

Its purpose in the organization was to accurately record and report on key financial data, such as:

- Operating cash flow ratio.

- Gross profit margin.

- Burn rate.

- Cycle time.

- Sales growth.

- Debt to equity ratio.

- Return on assets.

- Inventory turnover.

- Payroll headcount ratio.

- Many more.

Data often lacked dimensionality and wasn’t scalable, accessible, or, in some cases, meaningful enough to make substantive decisions about the future. Finance was successful at back-office accounting but its ability to innovate on behalf of the business as a whole was constrained.

Finance Goes Electronic

The advent of Microsoft Excel in 1985 provided an electronic foundation and framework for financial planning and analysis (FP&A), saving on labor, time, and decision-making. With greater speed, visualization, and formula-based rules built into the back office, data could be viewed with a new lens and by more stakeholders outside the finance function.

While the internet drove the proliferation of business applications in the ‘90s and early 2000s, the way finance was conducted remained largely the same, even though technology reshaped how it was done. More work could be completed and its impact better measured, but subsequent technological and process-oriented breakthroughs were still on the horizon.

In the last two decades, the IT department led the selection and implementation of new enterprise resource planning (ERP) systems that served as the data core for the business at large. ERPs like SAP, Oracle, and NetSuite offered the dashboarding, data compilation, and business management features that allowed executives the ability to see cross-departmental data faster and with greater visualization.

Finance could then ingest, track, measure, report, and analyze data from a digital command center.

Earlier generations of ERPs were still limited in their use cases relative to today’s cloud-based, unified systems, however. Companies might run several versions of an ERP and maintain legacy databases in various functional silos. Large corners of the data architecture were still black boxes depending on who was using or seeking a particular set of information and where they sat in the business.

The finance function was digitally connected within a confined ecosystem but still largely disconnected from other key functions.

Finance Operations Go Augmented

Adjacent to ERP integrations was the rise of offshoring. Transactional tasks were outsourced overseas, and businesses used shared-service centers to consolidate back-office operations.

Organizations found that offshoring routine finance functions could reduce labor costs by as much as 70%. GE, for example, offshored accounts payable and expense work to start, and then eventually handed over regulatory activities, compliance, cash management, and varying levels of decision-support augmentation.

In cases like GE, CFOs viewed outside resources as not just one-and-done taskmasters but as core parts of the finance operating model. At the time, this was an edge case, as the average enterprise CFO likely wasn’t comfortable with resource augmentation to this degree.

Moving other functions like customer service, supply chain, procurement, and HR outside the walls of the firm compounded cost and resource savings as well, especially as shared service providers grew more sophisticated and intertwined with the companies they supported.

The Modern Finance Function

By 2010, the composition, skillset, and mandate of the finance department were shifting considerably.

The modern finance function is strategically positioned in the business, with a much larger scope of work and ecosystem of tools and processes.

As digital transformation efforts made significant inroads to the OCFO, critical time and resources were redeployed to more strategic, value-add actions. This freed up the back office to think critically about the allocation of resources throughout the business, the future vision of the firm, and the paths to securing a larger share of the market.

The ROI on finance function effectiveness is now less binary. Analysts can measure and report on hard metrics like automation cost savings, but it’s hazier to pinpoint the numerical value of intangible efforts, like “charting a vision” or “becoming more risk resilient.”

Current finance functions now touch various other functions due to the overlap and synchronicity of software. Payroll, human capital management (HCM), ERP, financials, cybersecurity, and various other key business functions may rely on the same or similar software implemented by finance, solidifying the finance team’s responsibility to the business as a whole.

Finance Moves to the Cloud

Modern finance functions are breaking down silos between departments and between data architectures. In some cases, this means implementing a cloud enterprise management tool that other applications are bolted onto. Or it’s a platform that outright replaces legacy software and processes.

For example, a tool that sits across finance and HR, existing in one cloud data model, makes both functions easier to manage. A tool with a wide-ranging breadth of service empowers decision-makers to retire potentially dozens of other cloud tools previously in use.

An energized focus on data integrity, data visibility, and data insights has meant all business systems must be able to “talk” to each other in the same language and that internal controls are in place to ensure the real-time flow of data. The average enterprise uses 1,300 cloud applications and multiple types of cloud platforms (public, private, hybrid, etc.).

With finance data in the cloud, it can automatically be stored, archived, and synced with other data streams for greater analysis. For instance, HR and operational data like employee skills gaps, talent acquisition pipelines, and satisfaction ratings can be overlayed with budgets and actuals from the financial management team.

Cloud adoption enabled companies to get a grasp on the era of Big Data and all the opportunities and challenges it inaugurated.

As data volume and velocity went parabolic, not all firms had the resources and software to sort through the data and make sense of what was happening within the business in real time. Advanced business intelligence (BI) tools assembled, arranged, and systematized the structured and unstructured data now being generated. BI software works across formats, applications, and systems, extracting past, present, and future information for analysis.

Finance was able to deliver insights faster thanks to an arsenal of technologies in the cloud, Big Data, and BI spaces.

Finance Gets Automated

One of the chief transformations of the finance function – and the world of enterprise firms overall – is the introduction of robotic process automation (RPA) with machine learning (ML) and artificial intelligence (AI) capabilities.

Software robotics like RPA automated a majority of traditional financial management tasks, digitalizing items like audit trails, compliance, invoicing, accounts receivable, accounts payable, and payment processing. RPA bots work around the clock and can handle more than twice the volume of work that humans previously handled.

Explore expert Technology Optimization & Digital Innovation solutions that solve real-world problems

Accelerate strategic adoption of advanced technologies like AI, automation, analytics, and business intelligence platforms within a scalable systems architecture that works for your business today and tomorrow.

It’s estimated that 90% of global firms will implement RPA by 2022. By 2024, the RPA footprint within these organizations will triple. Already, RPA has exceeded or met company expectations, according to 92% of respondents to a Deloitte survey, and ROI was realized in less than 12 months.

Automation is also a powerful corrective. The following activities can be either remediated automatically or flagged for future human intervention:

- Data entry errors.

- Version, source, and formatting control.

- Debugging.

- Reconciliation.

- Access control.

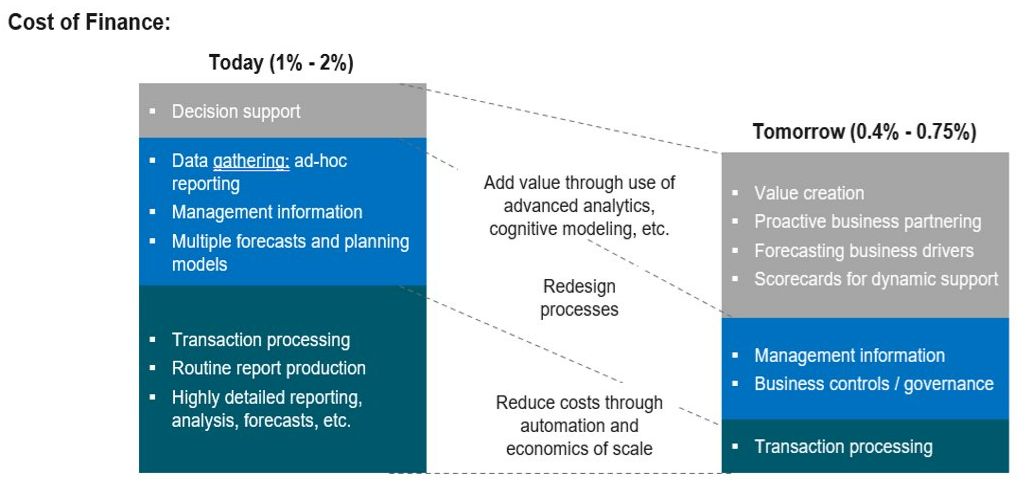

Positions handling rote tasks are quickly becoming obsolete, which reduces headcount in the finance function but also enables leaders to reallocate remaining resources to work that’s more conceptual and strategic.

Finance Moves Out of the Back Office

With finance – and much of the rest of the back office – now firmly digitized and automated, there’s new space for cross-functional partnerships and insights.

The modern finance function is able to extract value across the business by working with and leading other departments toward better decisions. This means a bigger seat at the executive table, with finance consulted or tasked with leading the selection of new enterprise tools, changes in business trajectory, or upskilling the workforce.

A successful finance operating model can be replicated across the business. Because finance is a common entry point for automation, the department is often the tip of the innovation spear. The takeaways, savings, and optimizations finance earned in recent years is a use case that can’t go unnoticed.

The Future Finance Function

The finance function of the future is another evolution.

One of Deloitte’s key predictions for the finance function of 2025 is especially pertinent.

“With operations automated, finance will double down on business insights and service. Success is not assured.”

Finance Becomes Stewards for Change

As the finance function sheds portions of its general accounting and financial management tasks, it’s expected to take on more work that’s commercially valuable. This includes a larger say in:

- Investor relations.

- Investment priorities.

- Service design.

- Retention and employee experience.

- Technology and systems implementation.

- Capital markets/business deals.

Overall, finance is becoming the voice for change in the business. As transformation reaches into all aspects of the business, finance must show ROI – and then help reorganize the business in a way that can manifest future iterations of ROI.

To do so might require restructuring certain business units, designing a better go-to-market strategy, and helping to equip employees with the technology and resources they need to feel part of the journey.

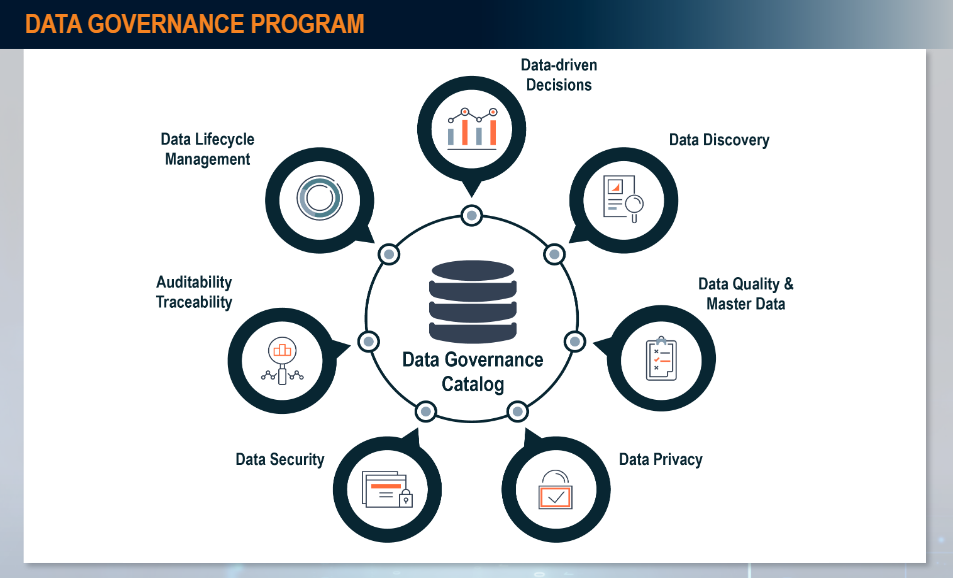

With real-time data on hand, there’s also less need for finance cycles – periods in which key financials are reported. All data is blending together into one reservoir, and though external vendors or investors may desire monthly or quarterly financial statements, the finance function no longer needs to be structured around cyclical activities.

The “always-on” nature of data means other departments might benefit from changes in structure and processes as well, freeing them from conventional cycle times. Real-time reporting capabilities might become a new standard, with finance leading data integrity and standardization efforts.

Finance Spearheads the Data Analytics Center of Excellence

Outsourcing and automating so many tasks has changed the role of the average finance worker.

Roles have changed, skills have changed, culture has changed, people have changed, markets have changed.

Now, strategic leadership must change.

Leadership across a distributed, asynchronous, global workforce is not easy but it will be mandatory, nonetheless. New business lines may be necessary; old ones sunsetted.

The establishment of a Data Analytics Center of Excellence (CoE) can be a new, effective throughline for the entire business. As data flows funnel into unified data architectures, the Data Analytics CoE can make decisions faster than ever, define new governance standards, and leverage data insights throughout the entire value stream.

The finance executive has the secondary – but increasingly primary – job of delivering valuable data insights and helping to lead the Data Analytics CoE.

In the past, finance handled numbers and controls. In the future, finance will deliver core business value.

Finance Delivers xP&A

Data will drive decisions not just for finance transformation but for firmwide business transformation. Finance will play a key role in extended planning & analysis (xP&A), synchronizing transformation efforts for the whole organization.

xP&A is about turning data into business answers, with multiple vectors at play. CFOs need to solve business problems, not just financial problems. This includes:

- De-risking the organization.

- Managing growth.

- Identifying new business opportunities.

- Increasing alignment and digital collaboration.

- Being intuitively change-ready.

Finance professionals must navigate continuous evolution. Those who can offer the insight, organization, and cross-functional value to the business will pave the way for the finance function of the future.

To evolve your finance function, contact the finance transformation experts at CrossCountry Consulting today.