With the market experiencing an evolving set of challenges and competition, FinTech companies are exploring new ways to gain an edge. One popular and productive lever is transitioning from a public entity to a private one. Below, we discuss what is driving this trend and explore key drivers behind the shift.

Market Observations

During bear markets, companies start to cut costs and focus on conserving cash, particularly companies with liquidity issues. Often, these businesses accelerate the sale of assets deemed non-core to the overall business model to raise much-needed cash.

Outside of traditional business unit divestitures, the industry is also witnessing more take-private deals, an advantageous option for both buyer and seller. For instance, FinTech companies that lost a significant amount of market value may be tempted to accept offers when the premium is over 40% of the current market value. On the other side, buyers are seeing an opportunity to buy at a significant discount. One example is when Vista Equity Partners purchased Duck Creek Technologies, an insurance software provider, in January 2023 for an all-cash offer of $19 per share or $2.6 billion. The purchase price represented a premium of approximately 64% over the closing stock price at the time of sale; however, it was still significantly lower than the $46 Duck Creek offered back in 2021.

Benefits of Take-Private Deals

- Less transparency: Public companies must comply with the SEC for financial reporting purposes, and every quarter they host earnings calls in tandem with filing their financial results. As a private company, this requirement is removed and the C-suite executives no longer need to worry about meeting analysts’ expectations or dealing with disruptive short-term shareholders. This shift often allows leadership to focus longer term without being under increased scrutiny, an attractive option for the management team.

- Reduced reporting costs: Private companies have significantly reduced reporting costs as they no longer need to comply with Sarbanes Oxley (SOX). Furthermore, public companies incur compliance, reporting expenses, exchange fees, and audit fees for both quarterly and annual filings, which private companies do not incur. The estimated savings on average to remove these costs is roughly $1 million in fees annually.

Explore a suite of expert Transactions solutions that solve real-world problems

Divest a business unit, execute a merger and acquisition, or transition to a public or private organization for maximum value and minimum risk in the deal lifecycle.

What Are the Deal Triggers?

- Declining share price: Economic uncertainty remains persistent, having an impact on smaller public companies that continue to see declines in their share price value. At the same time, the price decline presents an opportunity for potential buyers to buy out existing shareholders at a discount. As such, the appetite for take-private deals grows, especially when sellers face increased pressure and buyers are sniffing out new opportunities.

- Premium offer: Board members have a fiduciary duty to maximize shareholder value and a take-private deal can provide shareholders with a premium valuation that is well above a company’s current market price. This can be an attractive option for current shareholders to sell and exit their declining investment. For instance, when Elon Musk bought Twitter, the deal represented a 40% premium over the closing share price at the time of sale, an extremely attractive option for the board and shareholders, although both expressed concerns about Musk’s management style.

Private Equity Moves Cautiously

Private equity firms have large amounts of capital available (U.S. PE holds $1.1 trillion) and are eyeing such transactions. Although interest rates are high, a PE firm that thinks a deal makes sense from a valuation and growth perspective will likely proceed with a cash purchase, as they can always refinance or recapitalize the business when interest rates drop from current levels.

In addition to the opportunities within the public markets, privately owned FinTech firms are looking to sell off non-core assets to restructure businesses and focus on their core strategy. For instance, Finastra, an international banking and payments provider owned by PE firm Vista Equity Partners, announced in February 2023 that it was taking a strategic review of its business and looking to offload its banking unit division.

This has been a common theme over the last 12 months as FinTechs shore up their balance sheets and ensure they have enough cash to ride out the turbulent economic slowdown. Coupled with a venture slowdown and lack of IPO activity, access to capital is harder to come by. As a result, FinTech companies that don’t have enough cash look for ways to sell off assets to raise liquidity. The FinTech market has also seen many layoffs recently, fueled by the aforementioned squeeze companies are feeling. The expectation is that more M&A activity/consolidation within the industry will occur in Q3 and Q4 of 2023.

Private equity firms are scanning the market for FinTech and other financial services take-private deals, such as when Computer Services Inc (CSI), a leading provider of payment processing and regulatory compliance, announced the completion of its acquisition by private equity firms Centerbridge Partners, LP and Bridgeport Partners in August 2022. The acquisition was an all-cash transaction with a purchase price of $58 per share, or $1.6 billion, representing a 53% premium over CSI’s closing stock price of $38. Prior to the purchase, the share price of CSI had been in decline, falling 40% from $63 per share in July of 2021 to $38 per share at the date of purchase, making it an attractive offer for both buyer and seller.

This transaction reiterates what’s playing out in the market, as large amounts of private equity “dry powder” is beginning to create more deal flow. Below are recent discounts on offer:

(Source)

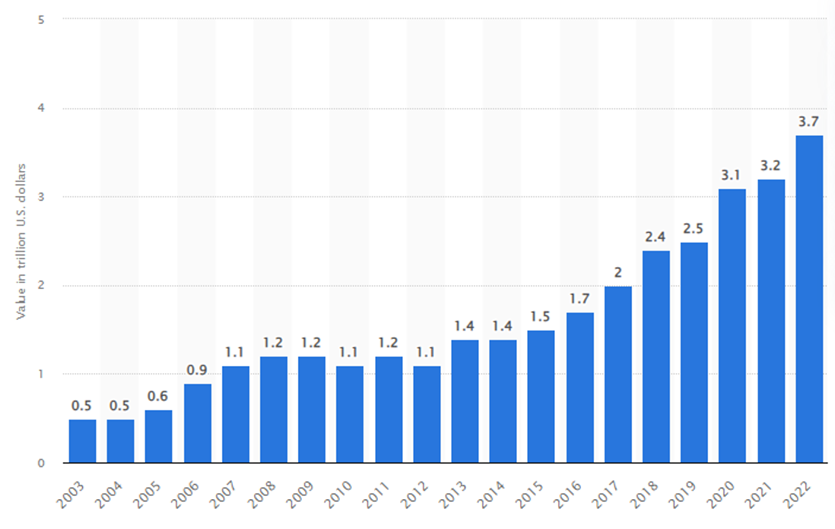

Value of Global PE Dry Powder 2003-2022

(Source)

Divestiture Opportunities an Attractive Option

Outside of an all-out equity purchase, some public companies are divesting parts of their businesses as they look to trim underperforming business units and raise much-needed cash. This dynamic will create opportunities for partial carve-out sales between public entities and private equity firms. Typically, these deals occur at a discount due to distressed prices. Such deals are an attractive play for private equity firms with longer-term objectives for the assets they’re acquiring, as evidenced by FIS announcing it intends to sell Worldpay and recent sales of Global Payments’ prepaid and gaming divisions.

With experience in the full lifecycle of take-private deals, CrossCountry Consulting supports transactions through sell-side and operational due diligence, accounting support, deal management, and post-close support, including detailed technical accounting and carve-out support.

To explore transaction opportunities today, contact CrossCountry Consulting.